The current sharp turnaround in the Kiwi dollar has triggered us to question, has the pattern of the in 2015 or two now altered from USD strength to weak point?

If so, how will this impact the New Zealand dollar, and regional NZ Dollar gold and silver costs?

Approximated reading time: 5 minutes

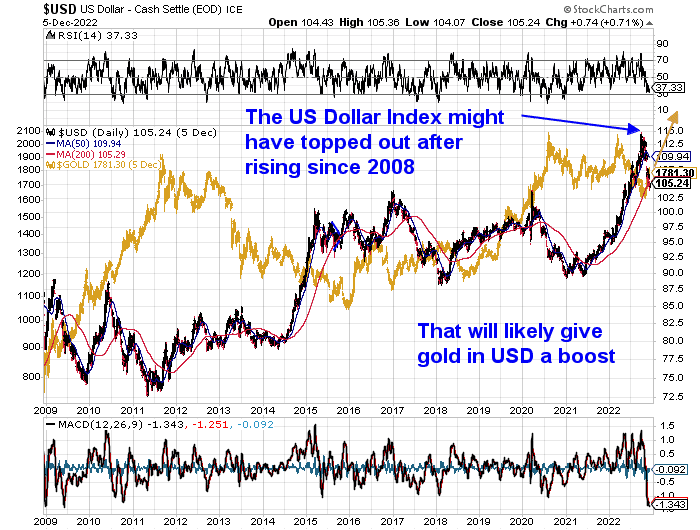

Longer Term– The USD May Have Actually Altered Course

The chart listed below demonstrate how the United States Dollar Index reached a high in September 2022 and has actually fallen greatly ever since. (Note: The United States Dollar Index is comprised of the following currencies: Euro 57.6% weight, Japanese Yen 13.6% weight, British Pound Sterling 11.9% weight, Canadian Dollar 9.1% weight, Swedish Krona 4.2% weight, and Swiss Franc 3.6% weight.)

The chart likewise reveals us that at the exact same time, gold in United States Dollars seems breaking greater and out of the drop it has actually remained in considering that early 2022.

So gold and the United States Dollar seem selling the inverted relationship to each other that they typically (although not constantly) relocation in.

Nevertheless we must keep in mind that after such a sharp relocation lower, in the much shorter term the United States dollar is most likely to recover up once again from here initially.

So What Does This Mean for the NZD?

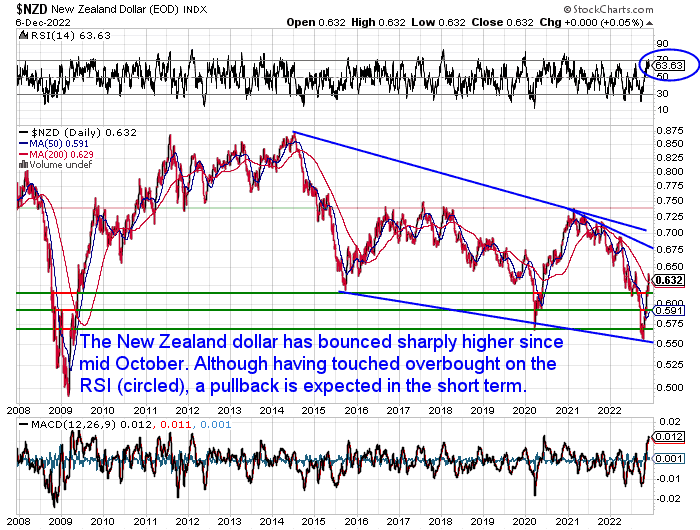

If the United States Dollar has undoubtedly had a modification of pattern and is damaging over the longer term, this will most likely indicate the NZ Dollar will continue to move higher from here. As you can see it has actually done considering that mid October (see the chart listed below). Although we are most likely to see a draw back in the short-term after increasing so quick and reaching overbought (above 70) on the RSI sign.

( Keep In Mind that as the NZ Dollar is not part of the United States Dollar Index, we can from time to time see the Kiwi Dollar relocate tandem with the USD Index).

What Will This Mean For Gold and Silver in NZ Dollar Terms?

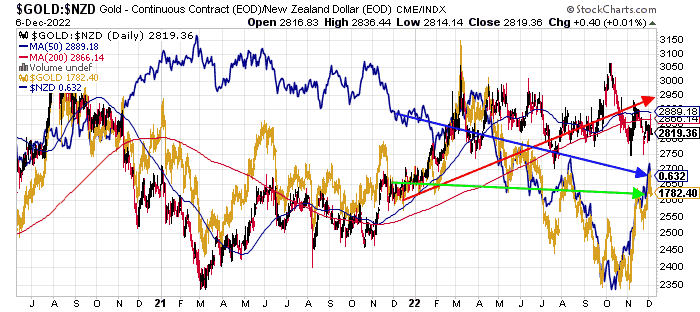

In the beginning look it might trigger the idea that the regional NZ dollar costs of gold and silver will fall from here. After all it is the weakening Kiwi dollar that has actually been the dominant consider pressing gold (and to a lessor degree silver) greater over the previous year in NZ dollar terms.

Have a look at the chart listed below to see this. It’s a bit hectic however we can draw a couple of points from it. We have actually drawn a rough pattern line in for each information set. The red line is for the NZD gold cost. The blue line is for the NZ dollar and the green line is for the United States Dollar gold cost.

You can see that the NZ Dollar over the previous year has actually been falling faster than the United States Dollar gold cost (suggested by the steeper blue line than the green line). So this has actually led to the regional NZ Dollar gold cost increasing– as it is a function of these 2 costs.

So if the NZ Dollar keeps increasing as quick as it has actually been, this might well counteract any gains in the United States Dollar cost of gold. And we’ll see a stagnant or perhaps falling NZ dollar gold cost.

However we question whether the Kiwi Dollar can keep increasing at the exact same rate of knots that it has provided for the previous 6 weeks? It was extremely oversold so has actually gotten better quick.

We question if a most likely circumstance is for a slower increase in general in the Kiwi? Possibly just support to around 74/75 cents?

So if the United States dollar gold cost keeps increasing as the United States dollar falls and the Kiwi increases more gradually from here, we might see the NZ Dollar Gold cost continue to increase still. Albeit at a slower speed than it has actually done recently.

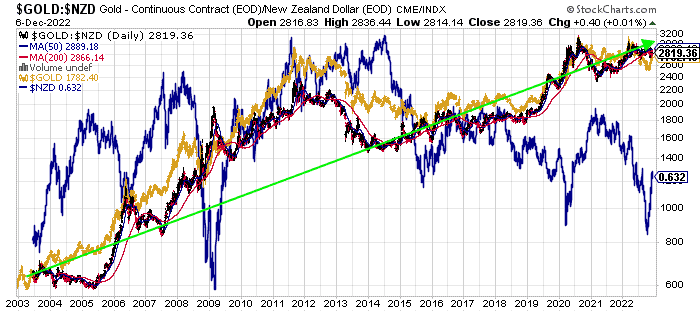

We have actually broadened the time scale from the above chart out to twenty years to provide a a lot longer term view listed below.

So this makes it clear that general whether you cost gold in NZ Dollars or United States Dollars, over the long term gold has actually been increasing in both.

Or put another method both currencies (or for that matter all fiat currencies) have actually been falling when determined in gold. With the issues in the international financial and monetary system still not resolved and international financial obligation having actually been ratcheted up even further considering that 2009, plus now inflation ending up being established, the chances are this pattern will continue for a while yet too.

To much better comprehend what technical analysis is, and aid with timing when to purchase silver or gold and have a look at this short article: Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Editors Note: This post was very first released 14 October 2015, when a pattern modification in the United States dollar index happened. Upgraded 7 December 2022 where a comparable pattern modification appears to be playing out.

Source link