Cracks in US Treasury Bond? Will This Prompt More Buying of Precious Metals?

Co sts and Charts

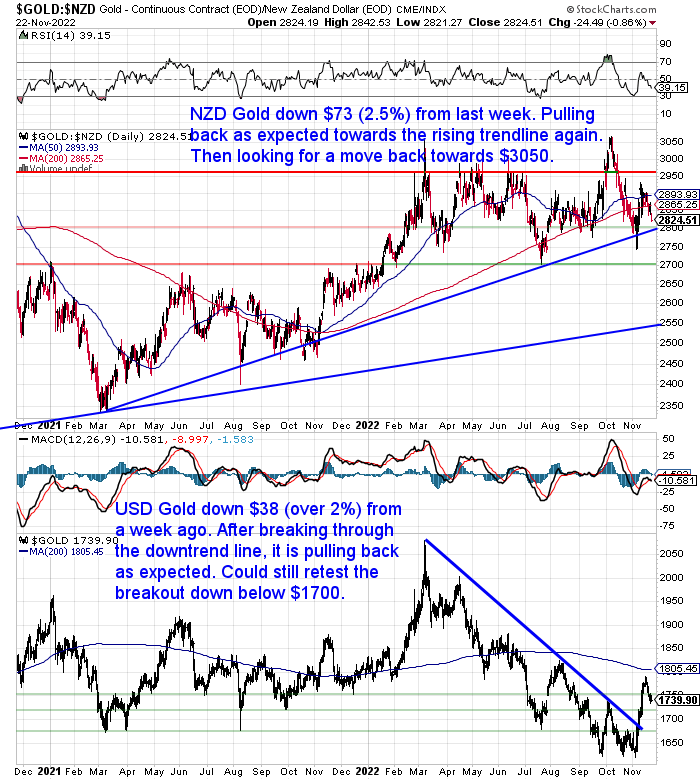

NZD Gold Pulling Again In direction of Uptrend Line

Gold in New Zealand {dollars} is down $73 (2.5%) from every week in the past. Pulling again as anticipated in direction of the blue uptrend line. Perhaps we’ll see a bounce from round $2800 or simply under? Then we’re anticipating a transfer again up in direction of $3050 once more.

Whereas in USD phrases, gold was down simply over 2% from 7 days prior. After clearly breaking by the downtrend line, and getting overbought, USD gold has pulled again as we thought it will. It may dip a bit decrease but too and check the breakout under $1700.

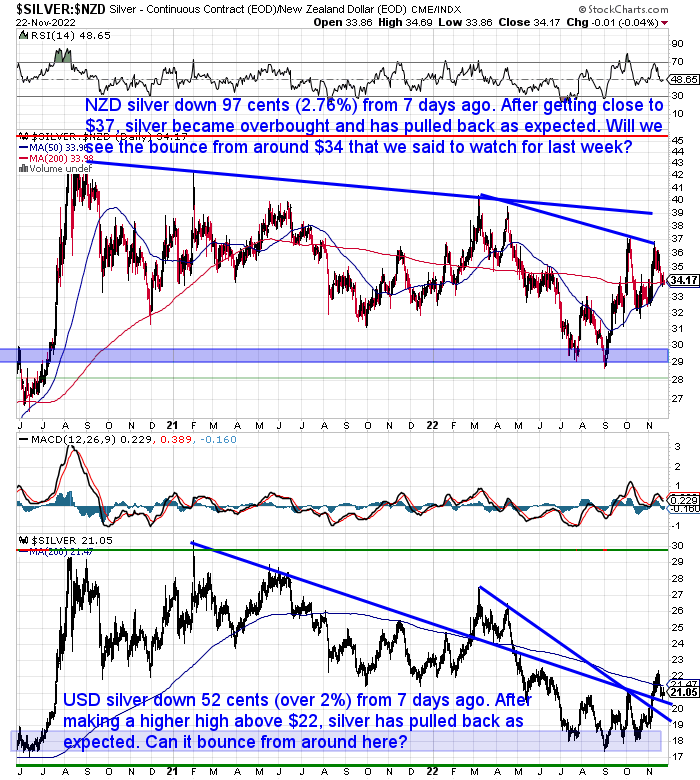

NZD Silver Sits The place the 50 and 200 Day MA Converge

Silver in NZD dropped the same quantity to gold share smart. Or down 97 cents. NZD silver now sits proper on the purpose the place the 50 and 200 day transferring averages (MA) converge at $34. So this may very well be a probable place for them to seek out help and bounce again up.

In USD, silver was down simply over 2% from final week. Can it bounce from round right here? Or possibly it might want to dip a bit decrease nearer to $20?

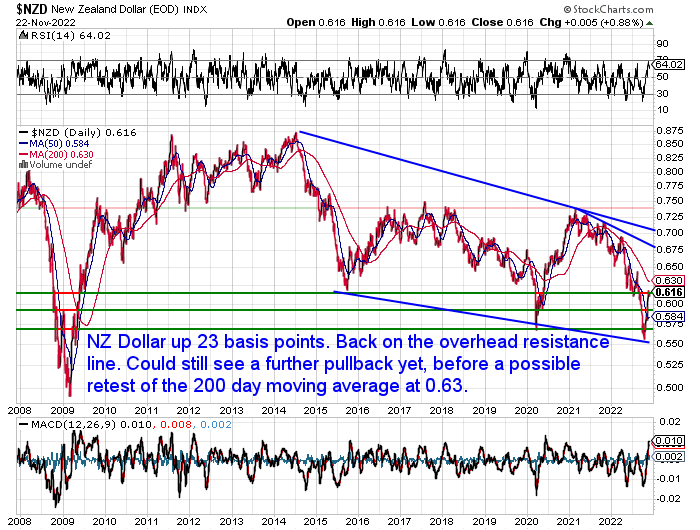

RBNZ 0.75% OCR Improve Nudges NZD Increased

The New Zealand greenback is up 23 foundation factors from every week in the past. All of that rise got here after the NZ Central Financial institution introduced a hefty 0.75% rate of interest improve at 2pm as we speak. Whereas this was a file price hike it was largely anticipated by the market and so the Kiwi hasn’t moved an excessive amount of because of this.

The RBNZ like different central banks are placing on their inflation preventing fireplace hats. However as we focus on additional on as we speak, we ponder whether they’ll be ready to maintain them on for so long as they’d like us to imagine?

Plus in our view these rate of interest will increase aren’t prone to have the impact on inflation that the RBNZ would really like. It’s not a “mixture of provide chain issues, geopolitical tensions, pent-up demand from lockdowns and an absence of labour” which have prompted the present inflation because the likes of this text says.

Inflation scenario: May we ever see a return of the Eighties’ 20% charges?

(Who would have thought we’d see a mainstream NZ article considering 1980’s rates of interest?)

However fairly the harm has already been performed prior to now with the huge improve in forex provide right here and all over the world. The chickens are coming house to roost and so they gained’t be turned again so simply.

Want Assist Understanding the Charts?

Try this put up if any of the phrases we use when discussing the gold, silver and NZ Greenback charts are unknown to you:

Continues under

Lengthy Life Emergency Meals – Again in Inventory

These simple to hold and retailer buckets imply you gained’t have to fret concerning the cabinets being naked…

Free Delivery NZ Huge*

Get Peace of Thoughts For Your Household NOW….

—–

What Sort of Silver Bar Ought to I Purchase in 2022? – The Final Information to Silver Bars

This week we lastly have NZ refined 5oz and 10oz silver bars again obtainable for order.

The estimated dispatch time can also be right down to 2 weeks for these, whereas orders for 1kg silver bars now gained’t be obtainable till the brand new yr. So when you’re mulling over what kind of silver bar to purchase, then you’ll want to try this week’s characteristic article. You’ll be taught every little thing you could know when shopping for silver bars together with:

- When to decide on silver bars over silver cash

- What dimension silver bar to purchase

- Professionals and cons of various silver bar sizes

- What’s essentially the most generally bought silver bar dimension

- Completely different manufacturers of silver bars

- Forged bars vs minted bars

Your Questions Needed

Keep in mind, when you’ve received a particular query, you’ll want to ship it in to be within the working for a 1oz silver coin.

Cracks in US Treasury Bond? Will This Immediate Extra Shopping for of Valuable Metals?

Following on from final week’s feedback on UK gilts (authorities bonds), we’ve been digesting a bit extra info on the state of world bond markets.

Our “secret funding advisor”, Chris Weber (be taught extra about him right here) this week shared a thought frightening article from the Monetary Occasions on the cracks beginning to seem within the US Treasury bond market.

The cracks within the US Treasury bond market

The meltdown in UK gilts uncovered the vulnerability of enormous bond markets. May the largest of them survive a wave of promoting?

The issue presently is that the Fed is attempting to promote down its greater than $7 trillion value of treasury bonds. However with rates of interest persevering with to rise this implies bond costs proceed to fall. So discovering patrons shouldn’t be proving to be really easy.

The FT article explains how industrial patrons and sellers of US authorities bonds are discovering the liquidity within the bond market is poor in comparison with latest historical past. So it’s taking for much longer to fill trades than it used to.

Chris Weber then factors out:

“What struck me is that the Fed can put an finish to this [low liquidity] by ending its bond sell-off, and even beginning to purchase bonds once more in large financial easing. The Fed is in a really tough scenario. Even when it needs to cut back inflation, brought on by its open market operations in promoting bonds, it might not have the ability to proceed to take action. In different phrases, “Pressured To Inflate”.

The 2 charts under illustrate this dire scenario.”

“The one on the left reveals how the buying and selling quantity in Treasuries has shrunk. It’s now practically as dangerous as 2008, when the banking system was in peril of freezing, and early 2020, when the Covid panic hit the markets and froze buying and selling. However neither of those occasions are current as we speak. As a substitute, everybody who borrows or lends is shocked on the unprecedented improve in Treasury yields during the last 12 months.

…The second chart reveals the massive improve in Treasury debt since 2008. That is the results of the Fed printing cash: creating it out of skinny air. Now they’re caught. Their prior actions have prompted inflation, and since they stopped pushing down rates of interest these charges have zoomed. This pushes down bond costs, and therefore, fewer folks wish to personal them.

Those who personal essentially the most of them, the Fed and the Financial institution of Japan, have been systematically promoting them over the previous yr or two. However the numbers of smaller holders are additionally eliminating them.All these sellers and nearly no patrons. All of the whereas, the provision has grown enormously, courtesy of the Fed.

It will be deeply ironic if the identical Fed ended up shopping for extra Treasury debt, the very motion which begins the inflation course of. And but it appears to be like like that is the way in which issues will go.

The creator of the debt will doubtless be the one one who stands prepared to purchase them. However that motion will enhance the stability sheet, and begin the inflation course of over again.These subsequent few years are usually not going to be simple; you possibly can take a look at what’s coming as the worth that needs to be paid for the substitute ‘good occasions’ of the previous years. That is often known as ‘kicking the can down the street’. The issue is that the street is ending in a cul-de-sac, in any other case referred to as a useless finish.

…The Fed has impressed individuals who didn’t imagine it may keep so tight and have charges so excessive. Sooner or later it’s a must to imagine it can panic, if the economic system falls aside, or if the Treasury bond market does. This to me, stays the most secure wager. If that’s the case, then which funding class ought to most profit? Perhaps I’m falling too simply for it once more, however I’m pondering it will likely be the dear metals, particularly silver.

…The thought happens that the market will quickly begin discounting new Fed easing as a method out of the Treasury mess. It might already be within the technique of doing so.

If so, then it’s a good argument for a brand new bull market within the treasured metals.”

FTX Saga: The First of Many Collapses to Come?

If you wish to learn an incredible abstract of the latest FTX digital forex alternate collapse, this one from Myrmikan Capital is tough to beat…

The conclusions are laborious to argue with and level to this being simply considered one of many collapses to come back. And never simply within the digital forex world…

“Along with normal classes, the FTX saga has extra fast implications for traders. First, it’s one more sign that the COVID bubble is collapsing and at an accelerating tempo. The COVID bubble rests atop the QE bubble, which sits on the shadow banking system bubble, which depends on the banking bubble, which depends upon the forex bubble. The questions are at what layer of bubble will the Fed make a decided protection and can it’s profitable.

The second revelation of FTX is simply how lengthy it takes for wildly bancrupt establishments to fail. Panics all the time begin on the periphery. Within the nineteenth century they’d begin in locations like Argentina and take a complete yr to achieve again to London. Sub-prime housing exhibited the identical phenomenon, taking eighteen months to journey from trailer parks to Wall Avenue.

Every establishment scrambles to outlive: Bear Stearns, then Fannie Mae, then Lehman, then AIG, then Citigroup; Luna, Three Arrows, Voyager, FTX, Blockfi. It sells fairness, borrows cash, helps asset costs out there, maybe misappropriates funds, after which fails. And that solely begins the method for the following firm within the chain. It’s, maybe, exceptional that all the crypt0 universe didn’t collapse Monday morning.

However, because the above reveals, it takes time for contagion to unfold.The panic will in some unspecified time in the future leap to extra conventional monetary establishments, and never simply these concerned in crypt0. We are able to use the identical evaluation as above to grasp why no main establishment has but failed from the vertical spike in rates of interest.

A lot latest funding chatter factors out that almost all mortgages within the U.S.

are fixed-rate, versus these within the U.Ok., Canada, and Australia. However somebody is on the hook for the cash. Nobody ties up cash for thirty years to lend at a set 2.7% rate of interest. The shadow banking system permits short-term capital to fund long-term investments in the identical method that demand deposits at banks are used to finance mortgages and industrial loans. On condition that mortgage charges have been principally under 4% since 2012 and practically all the U.S. Treasury bond yield curve is usually above 4% (and lenders should pay a premium above that yield to entry capital), somebody is taking persistent losses:

particularly for latest mortgages, they’re getting 3% yield on their capital whereas paying 5% or 6% to entry capital.We are going to hazard a guess that it’s the pension funds and insurance coverage firms, those that have been shopping for the fairness tranches of CMOs, that can endure the best losses. Their stability sheets are big, and they’re going to have the ability to stagger on for a time. Others will present further capital understanding that they’re systemically vital. Ultimately the Fed won’t enable them to fail. It must print. This time when capital panics out of the greenback and greenback property, there may be one fewer exit.”

Supply.

So each these items level to the most certainly results of all that is for the Fed (and different central banks), to easily try to print their method out of the messes which might be but to come back. That’s to resolve the issue with precisely what prompted it within the first place. It’s laborious to see how this gained’t in finish in additional vital devaluation of all fiat currencies.

Have you ever received enough safety?

- E mail: [email protected]

- Cellphone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Store On-line with indicative pricing

— Ready for the surprising? —

By no means fear about protected ingesting water for you or your loved ones once more…

The Berkey Gravity Water Filter has been tried and examined within the harshest circumstances. Again and again confirmed to be efficient in offering protected ingesting water all around the globe.

This filter will present you and your loved ones with over 22,700 litres of protected ingesting water. It’s easy, light-weight, simple to make use of, and really value efficient.

Store the Vary…

—–

Source link