Rates and Charts

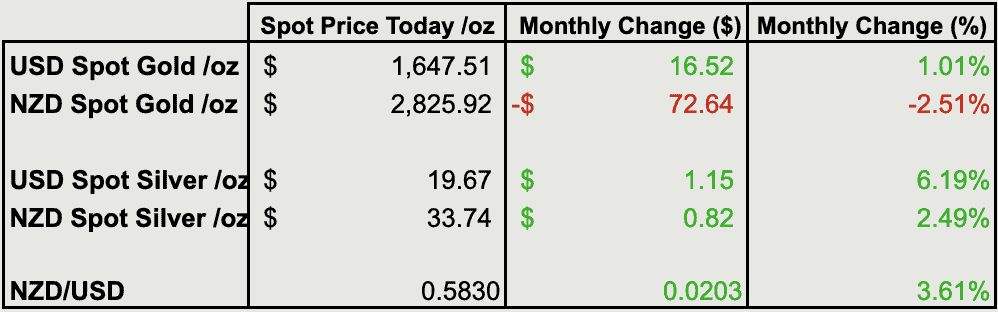

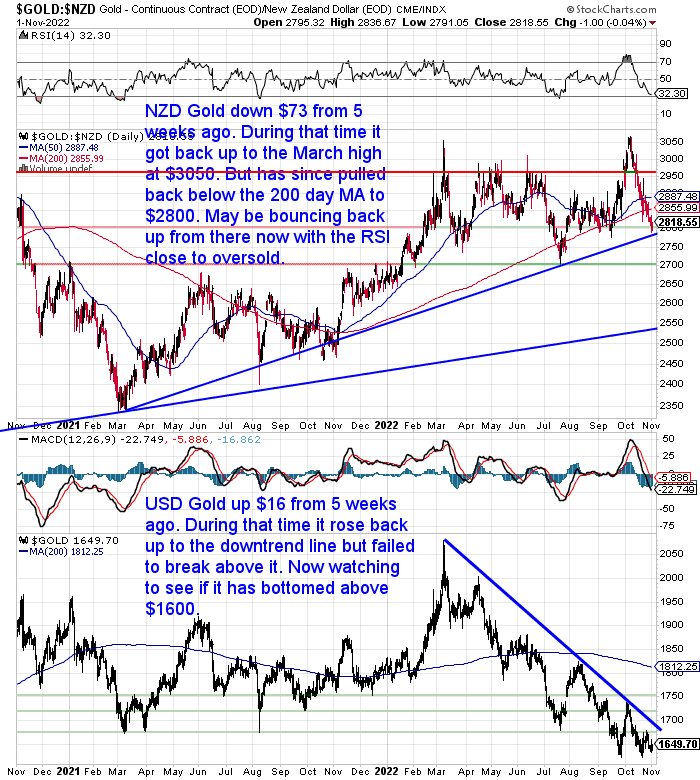

NZD Gold Rose To March High However then Backtracked All That Move

Because our last newsletter 5 weeks earlier, gold in New Zealand dollars is down $73. Nevertheless throughout that time NZD gold did climb up right back up to the March high at $3050. However has ever since returned down to the $2800 level which it has actually bottomed out at numerous times given that July. This level likewise accompanies the blue uptrend line and with the RSI overbought/oversold sign getting near to oversold. So there’s a great chance we need to see gold bottom out someplace around here.

In USD terms the sag given that March continues. Because we last composed USD gold did return approximately the sag line, however stopped working to break above it. It then returned down to simply listed below $1650. We are seeing to see if it can hold above there now.

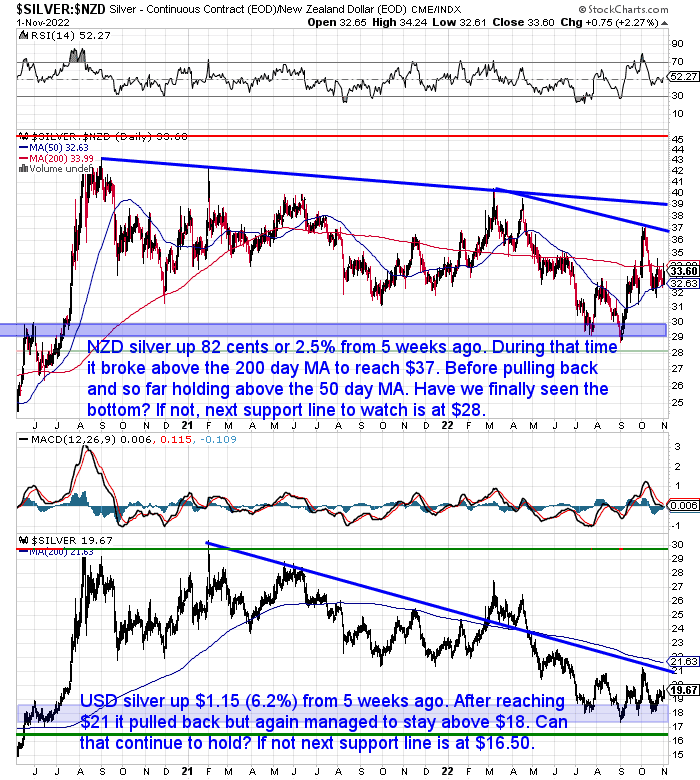

NZD Silver Holding Above the 50 Day Moving Typical

In contrast to gold, silver in New Zealand dollars is up 2.5% given that we last composed. Throughout that time, and like gold, NZD silver broke greater and reached $37. However has actually drawn back ever since, up until now holding above the 50 day MA. Have we lastly seen the bottom simply listed below $29? If not then the next assistance line to see is at $28.

USD silver is up over $6 from 5 weeks earlier. After reaching $21 it has actually drawn back however handled to remain above $18. Can that continue to hold and have silver bottom out at $17.50? We’ll keep seeing.

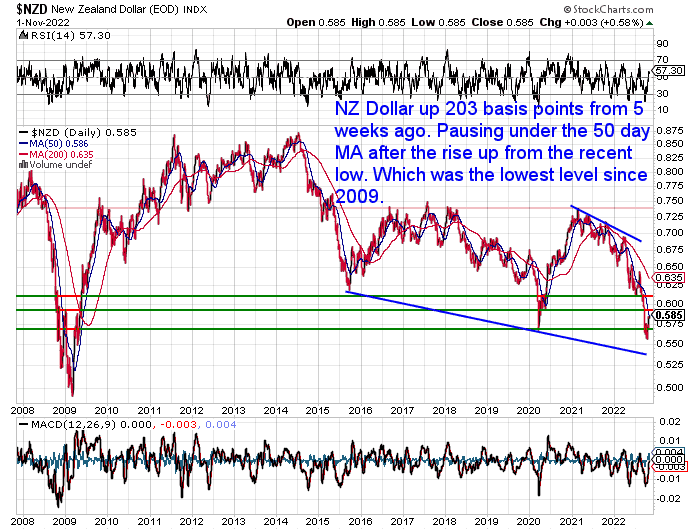

New Zealand Dollar Up Over 3.5% From 5 Weeks Ago

The sharp fall in the New Zealand dollar has actually lastly stopped or possibly is relaxing a minimum of. From 5 weeks ago the NZD is up 3.61%. Presently stopping briefly at the 50 day moving average after rising from what was the most affordable level given that 2009. It might still run a bit greater yet. However will require to increase a lot greater, prior to we see a modification in the sag that’s remained in play given that early 2021.

Gold purchased in New Zealand dollars has actually used defense from this sag throughout that time. Simply as it has in currencies that have actually carried out even worse, such as the Excellent British Pound.

Required Assistance Comprehending the Charts?

Have a look at this post if any of the terms we utilize when going over the gold, silver and NZ Dollar charts are unidentified to you:

Continues listed below

Long Life Emergency Situation Food– Back in Stock

These simple to bring and save pails suggest you will not need to stress over the racks being bare …

Free Shipping NZ Wide *

Get Assurance For Your Household NOW …

—-

We have actually got a number of function short articles today:

Gold vs Stocks: Historic Returns

The very first has a look at how gold has actually carried out versus stocks over different durations. We’ll see how various times can suggest one does much better than the other.

What Are The Various Kinds Of Gold Bars?

Then we take a look at the various alternatives that exist when it concerns purchasing gold bars consisting of:

- Categorised by production: cast and minted gold bars

- Categorised by weight: Conventional Gold Bars vs. CombiBars

- Categorised by refinery levels

- The benefits of purchasing gold bars

Your Concerns Desired

Keep In Mind, if you have actually got a particular concern, make sure to send it in to be in the running for a 1oz silver coin.

The Huge Concern: Will the Fed “Pansy Out” and “Pivot”?

We have actually read a variety of short articles that think the United States reserve bank is most likely to pull back from its rates of interest boosts or a minimum of slow the rate of them prior to too long.

David Brady of Sprott Cash composed:

” The marketplace definitely thinks that the Fed will slow their walkings moving forward, even if they raise rates 75 basis points next week. We understand this due to the fact that stocks skyrocketed, small bond and genuine yields fell, the dollar disposed and is now checking essential assistance, and financial metals climbed up off their lows. Now it depends on the Fed to ruin the optimism or sign up with the other reserve banks by downsizing their rate walkings– to put it simply, “pivot”.”

Source: Fed’s Pivot is Unavoidable

Financial expert Nouriel Roubini states the Federal Reserve is going to “wimp out” on the inflation battle which will result in a dollar crash.

” Today, all reserve banks are playing difficult, and talking difficult, and acting difficult– hawkish– due to the fact that they have an issue of trustworthiness. However in my view, there are 2 issues. One issue is if they attempt to get to 2% inflation, they trigger an economic downturn. And this economic crisis is not going to be brief and shallow. It is not going to be garden range. It’s not going to appear vanilla. It’s not going to be 2 quarters of unfavorable development and after that inflation collapses and they can reduce once again. … It’s going to be an extreme economic crisis due to the fact that of the financial obligation ratio– due to the fact that we’re entering into financial and financial tightening up. And at the very same time, not just do we have a financial crash, you’re going to have likewise a financial crash.”

… Once the Fed is going to basically avoid a financial and monetary crash– or attempt to avoid it by … stopping raising rates, despite the fact that inflation is expensive, then the dollar is going to begin to greatly damage. That is going to be the trigger for it. Due to the fact that what is raising the dollar is tight financial policy.”

… Gold has actually refrained from doing extremely well due to the fact that you have tight financial policy and a strong dollar. However if reserve banks are going to blink and wimp out, gold is going to increase in worth.”

Source.

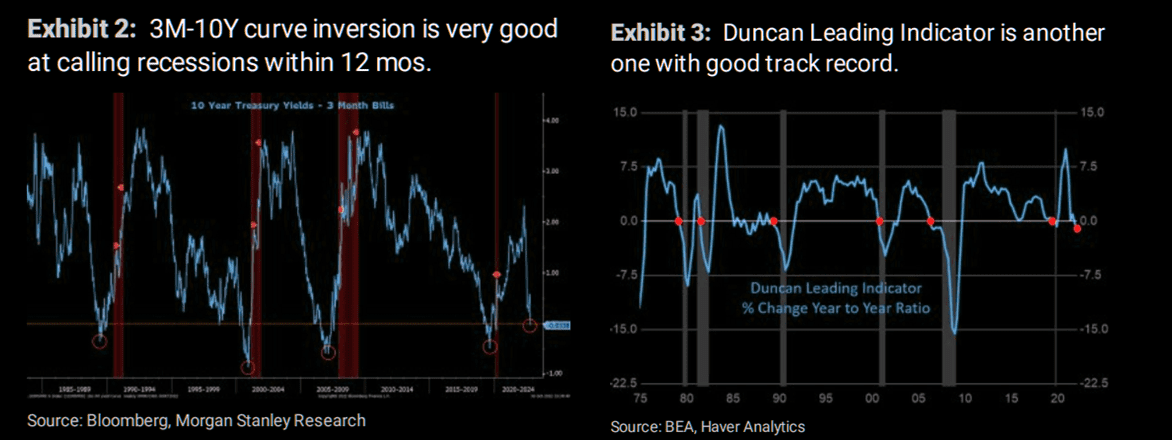

While The marketplace Ear shared some charts from Morgan Stanley that reveals a Fed pivot might be near …

A Fed pivot quicker instead of later on

3M-10Y yield curve inversion, an unfavorable y/y % modification in the Duncan Leading Indication, and M2 development that is plunging towards no all support a Fed pivot quicker instead of later on …”

Morgan Stanley

Source.

Next, this fascinating post talks about a procedure of liquidity and how it is revealing increasing indications of tension in the banking system.

The FRA-OIS spread compares rates of interest required by banks with global threat to provide to each other, to over night safe rates of interest which is Fed Funds based. i.e. what banks need of each other versus the rate set by the United States reserve bank.

This step has actually now surged approximately the very same level as when Putin attacked.

“ THE BREAKING POINT IS EXTREMELY CLOSE.

Why 10-15 bps? We feel since that is where the last spike got inexplicably topped at the creation of the Ukraine-Russian war. Someone actioned in then, and it is affordable to believe someone will action in near that level once again. Yellen most absolutely rotated fiscally Thursday and Friday. The cash used to Switzerland and the UK today was straight associated to this sign increasing we ‘d bet.”… THEY DONT NEED TO LOWER RATES TO PIVOT THIS TIME- However they will

This time, nevertheless, the Fed might keep treking a minimum of longer than we feel they should, however bail out the ones (banks, pensions, or markets) they consider worth conserving. That is a pivot, even if they do not lower rates. Isn’t that what the UK simply did?Is this not what the United States is indirectly doing since today. Experience what was done by (Dammit Janet) Yellen’s DOT these previous 2 days alone. The Fed isn’t rotating yet. The DOT is doing it for them on the heels of the UK’s short-term QE idiocy. The last two days:

DOLLAR WINDOW OPENS: Swiss National Bank today drew almost $6.3 billion from the U.S. Federal Reserve’s currency swap line center Oct 13th- RTRS

IMF FINANCING DEMAND: Yellen informed a press conference that the Treasury has asked the U.S. Congress for approval to provide $21 billion in existing U.S. Unique Illustration Rights (SDR) to IMF- Oct 14th- RTRS

QE DURING QT: U.S. Treasury asks significant banks if it should redeem bonds- Oct 14th- RTRS

Source: FRA-OIS States Powell Didn’t Rotate Yet, However Yellen Sure Did

Will We See Numerous Waves of Inflation?

So then what takes place if the Fed and other reserve banks do pause their rates of interest walkings?

Possibly we see inflation dip therefore everybody believes the main lenders have fixed it? Just to see another spike in inflation rates down the line?

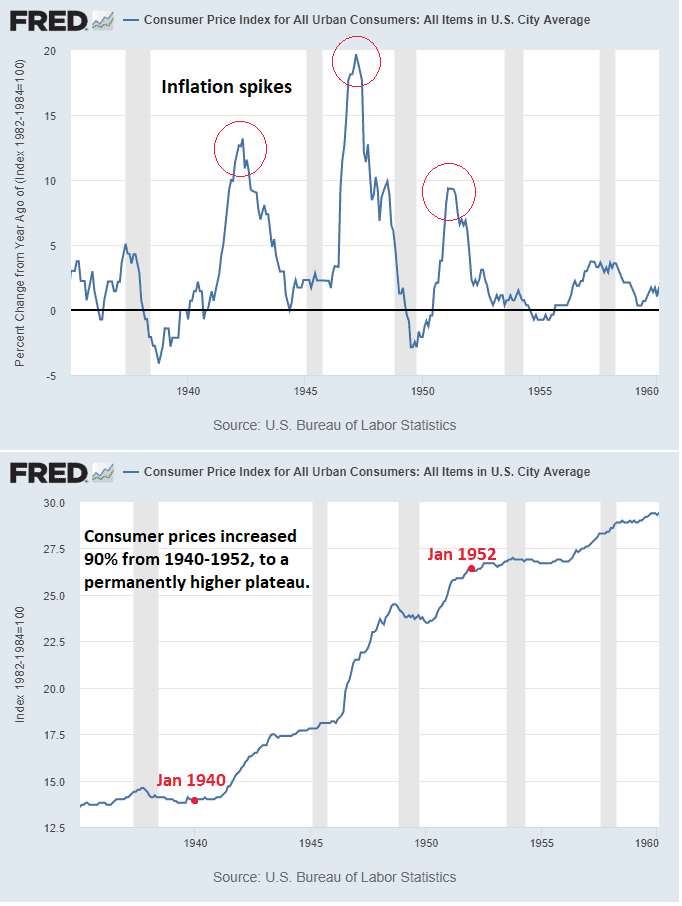

Lyn Alden Tweeted this chart and commented that:

” The 1940s had numerous waves of inflation too.”

Here is a substack post from Andreas Steno Larsen that discusses this more completely:

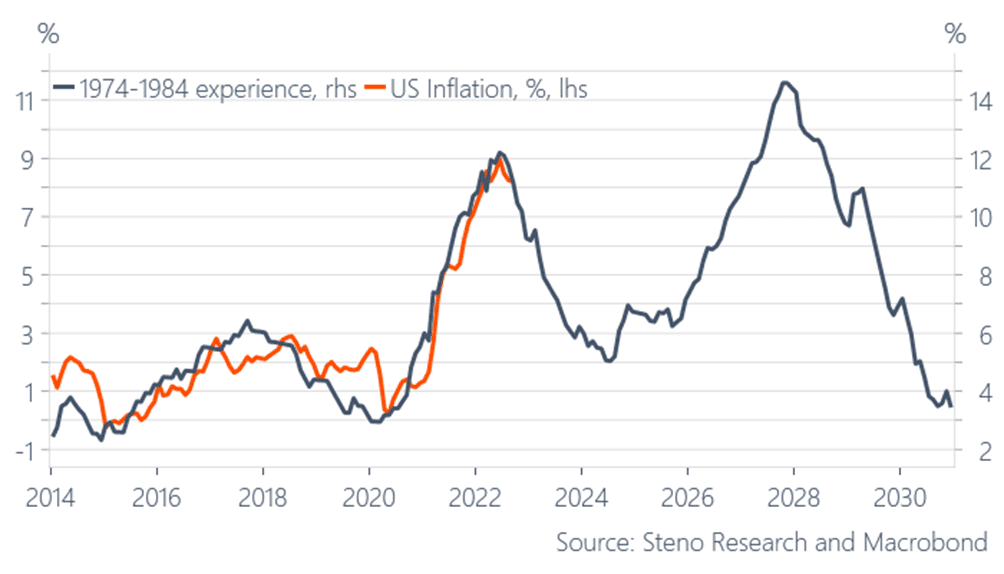

” Even if the zero-interest-rate policy is ideally dead and buried by now, I would not dismiss that we begin going over (much) lower rates of interest once again throughout 2023/2024 due to the upcoming economic crisis. A lot of, if not all, of my inflation signs indicate significant disinflation in 2023, which is most likely to reignite the conversation of rate cuts and reserve bank rotates.

BUT! … We have actually never ever had inflation performing at existing levels without experiencing a so-called double leading inflation routine. That held true in 1974-1980 and in 1946-1951. The factor is easy. As quickly as disinflationary patterns get clearer and clearer, everyone (consisting of political leaders) will be yelling at the Fed and the ECB to pivot. Reserve banks will likely collapse under tremendous external pressure, no matter what they are stating presently. Simply look how intensively we have actually talked about the reserve bank pivot over and over this year, and the majority of possession supervisors, pension funds and financial investment banks still hope and hope that the pivot will show up due to their possession allowance, which is still primarily based upon observed patterns from 2008-2021.

Chart 4. We have actually constantly seen double tops in inflation, when inflation gets as hot as it is now

Markets will as a result likely attempt and chase after the no time worth of cash story again over the next couple of years, prior to the next inflation wave starts. The clever financier disregards it and makes sure that the portfolio is adequately inflation safeguarded for the years ahead. Source.

We concur that it might be something like a years of inflation to come. Do you have adequate defense in location from a long term loss of buying power in dollars?

Contact us if you have any concerns about silver or gold:

- Email: [email protected]

- Phone: 0800 888 GOLD (0800 888 465) (or +64 9 2813898)

- or Store Online with a sign prices

— Gotten ready for the unforeseen?–

Never ever stress over safe drinking water for you or your household once again …

The Berkey Gravity Water Filter has actually been attempted and checked in the harshest conditions. Time and once again shown to be efficient in supplying safe drinking water all over the world.

This filter will supply you and your household with over 22,700 litres of safe drinking water. It’s easy, light-weight, simple to utilize, and really expense efficient.

Store the Variety …

—-

Source link