Silver Allocation of 4% to 6% Optimal In Investment Portfolio

Rates and Charts

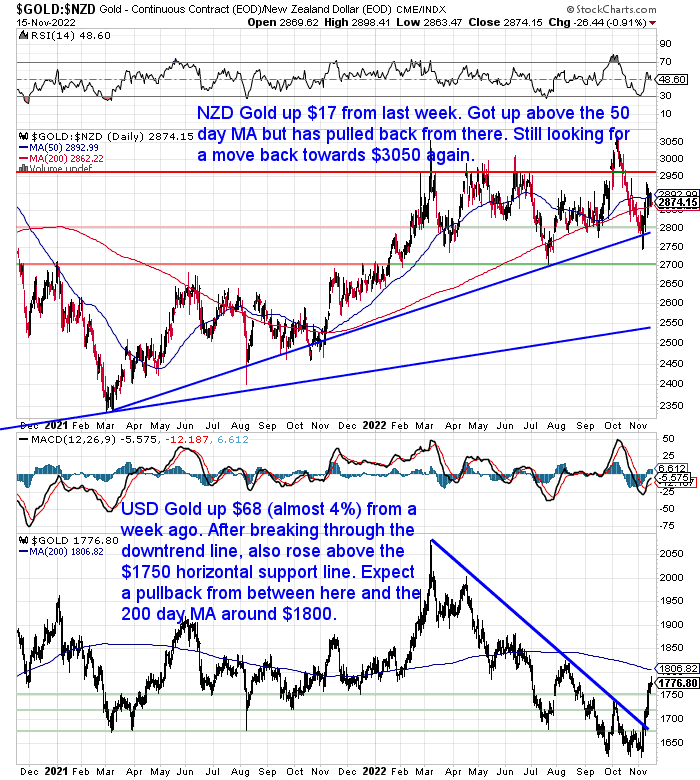

NZD Gold Drawing Back After Sharp Run Greater

Gold in NZ Dollars is up $17 from 7 days back. It got up near $2950 however it has actually drawn back a little from there. Now sitting simply above the 200 day moving average (MA). We’re still looking for a return towards the $3050 high from October and March.

Alternatively, gold in USD terms has actually had a strong run greater. Having actually broken above the sag line, it’s up almost 4% from a week back. USD gold is now approaching the 200 day MA around $1800. So the chances are high we’ll see a pullback from around there with the RSI entering into overbought area.

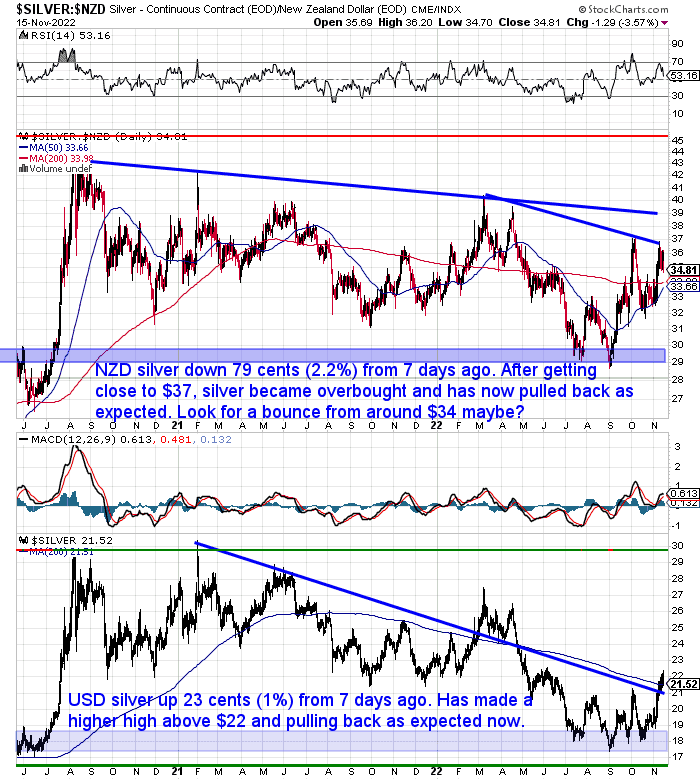

NZD Silver Down Over 2%

On the other hand silver in NZ dollars is down over 2% from recently. Entirely care of the much more powerful Kiwi dollar. After getting up near $37 silver ended up being overbought and has actually now drawn back as we believed it might. We’re now looking for a possible bounce up from where the 50 and 200 day MA’s assemble at around $34.

Silver in USD has actually continued its run greater. Getting above the 200 day MA, it seems making a greater high above $22. Drawing back now as anticipated. Looking for a greater low perhaps around $20?

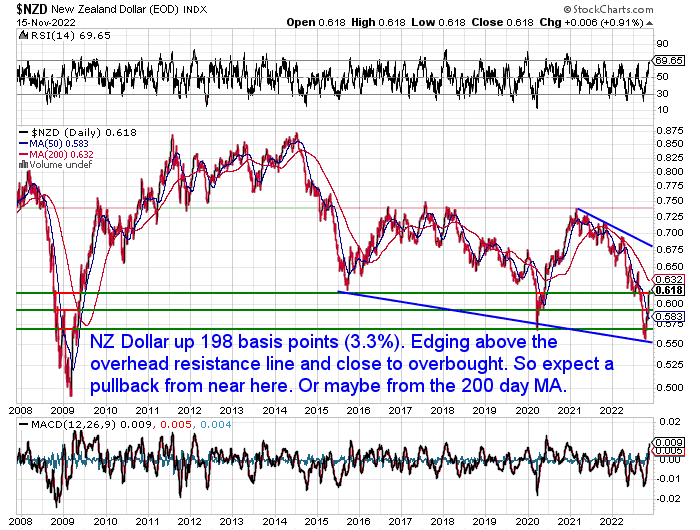

NZ Dollar Rises By 3.3%

As kept in mind currently, the Kiwi dollar has actually had a strong week. It has actually risen greater by practically 200 basis points or 3.3%. It has actually edged above the green horizontal resistance line, however is now approaching overbought on the RSI (above 70). So we must anticipate a pullback from in between here and the 200 day MA at 0.63.

Required Aid Comprehending the Charts?

Take a look at this post if any of the terms we utilize when going over the gold, silver and NZ Dollar charts are unidentified to you:

Continues listed below

Long Life Emergency Situation Food– Back in Stock

These simple to bring and save containers suggest you will not need to stress over the racks being bare …

Free Shipping NZ Wide *

Get Comfort For Your Household NOW …

—-

Are Increasing Rate Of Interest Beginning to Trigger Issues in the Rates Of Interest Derivative Market?

Back in September the exit of Liz Truss as U.K. P.M. was most likely brought on by what are called rates of interest derivatives …

” Essentially pension appear to have actually been captured in doom-loop of margin contacts rates of interest derivatives that required them into discarding longer-maturity UK gilts, and stimulated the Bank of England into stepping in today.”

Source.

So the BoE started purchasing UK gilts (i.e. federal government bonds) to stop rate of interest increasing even more. That in turn made Truss’s financial obligation moneyed tax cuts begin to look a rather bad concept. The rest as they state is history.

However exactly what are rates of interest derivatives? How huge could the threat be to the worldwide economy?

We have actually been following the worldwide acquired balloon for several years. It is these rates of interest derivatives that seem the greatest threat.

So today we have: Derivatives– a Newbie’s Guide to “Financial Defense of Mass Damage”.

You’ll find:

- What is a Derivative?

- The History and Origin of Derivatives

- Why Rates Of Interest Swaps are the Dominant Acquired

- Rates Of Interest Derivatives Could be the Source of Huge Problem

- 2022 Rate Of Interest Increases Triggering Issues?

- What Do These Derivatives Mean for New Zealand?

- NZ Bank Derivatives Have Grown Too

- How to Safeguard Yourself from Acquired Threat?

Your Concerns Desired

Keep In Mind, if you have actually got a particular concern, make sure to send it in to be in the running for a 1oz silver coin.

Counterparty Threat– Rates Of Interest Derivatives vs Silver

The difficulty with derivatives is the threat of contagion. As each derivative has a counterparty to it.

As we describe in this week’s post above, they do not always “net” each other out. One side might collapse while the opposite stays in force. If contagion happens all of a sudden the worldwide monetary system might be at threat.

However we will not understand about this till it’s far too late. That’s why it’s much better to be years too early than a minute too late when securing yourself from these long tail/outlier threats.

For more on counterparty threat see: Why Gold Bullion is Your Financial Insurance Coverage (& & How It’s Still Not Far Too Late to Purchase)

Gold is the apparent option to secure yourself from counterparty threat.

Nevertheless silver might play a larger function than numerous would believe …

Silver Allowance of 4% to 6% Optimum In Financial Investment Portfolio

A brand-new report by OxfordEconomics & & The Silver Institute promotes a substantially greater allotment to silver by institutional & & specific financiers than the majority of would anticipate.

” While silver’s rate motions are typically carefully associated with gold, Oxford Economics’ analysis recommends that silver’s return qualities are adequately various from gold to make it an important diversity tool that deserves its own portfolio dedication. With over half of worldwide silver need utilized in commercial applications, the rate of silver tends to be more delicate than gold to patterns in the worldwide commercial cycle, adding to its greater volatility. Additionally, silver is most likely to gain from a significantly favorable structural need outlook over the medium term, provided its usage in numerous green innovations, showing that we might be going into a duration where the gold-silver rate ratio moves back in favor of silver.

Based upon their forecasts for property returns, Oxford Economics examined the prospective habits of silver relative to other property classes and its function in an optimum portfolio over the next years. This analysis recommends an even greater ideal portfolio allotment to silver of around 6 percent would be necessitated over this duration.”

Complete report offered here.

Contact us if you require assistance structure your silver to 4% to 6% of your financial investment portfolio.

- Email: [email protected]

- Phone: 0800 888 GOLD (0800 888 465) (or +64 9 2813898)

- or Store Online with a sign prices

— Gotten ready for the unanticipated?–

Never ever stress over safe drinking water for you or your household once again …

The Berkey Gravity Water Filter has actually been attempted and checked in the harshest conditions. Time and once again shown to be reliable in offering safe drinking water all over the world.

This filter will offer you and your household with over 22,700 litres of safe drinking water. It’s easy, light-weight, simple to utilize, and extremely expense reliable.

Store the Variety …

—-

Source link