Here’s Why Central Banks Won’t Tighten Hard Enough and Long Enough

Co sts and Charts

NZD Gold Up Nearly 2%

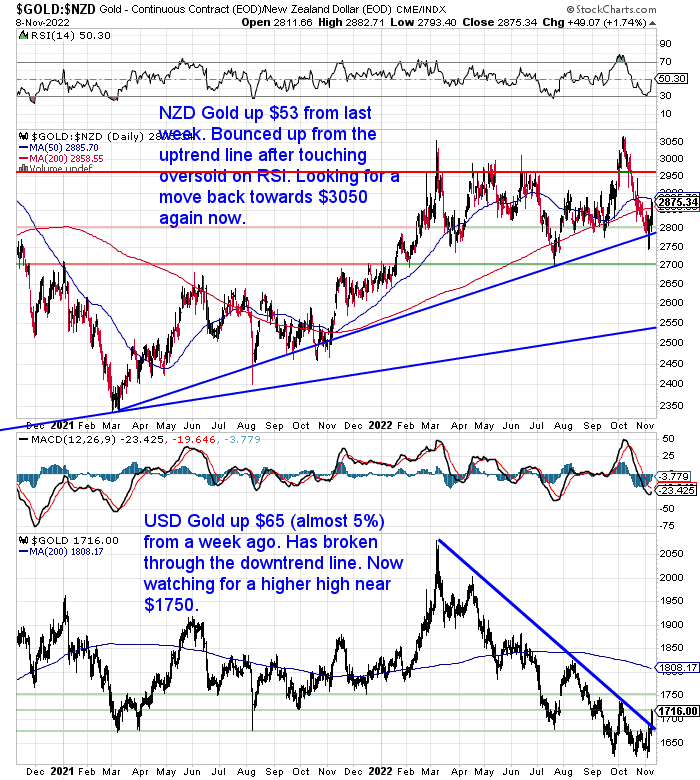

Gold in New Zealand {dollars} dipped right down to the blue uptrend line through the previous week. However then after touching oversold on the RSI, gold has bounced up from there to be up $53 or near 2% from 7 days in the past. We’re now looking ahead to a transfer again in direction of $3050 once more. However NZD gold stays within the clear uptrend it has been in since early 2021.

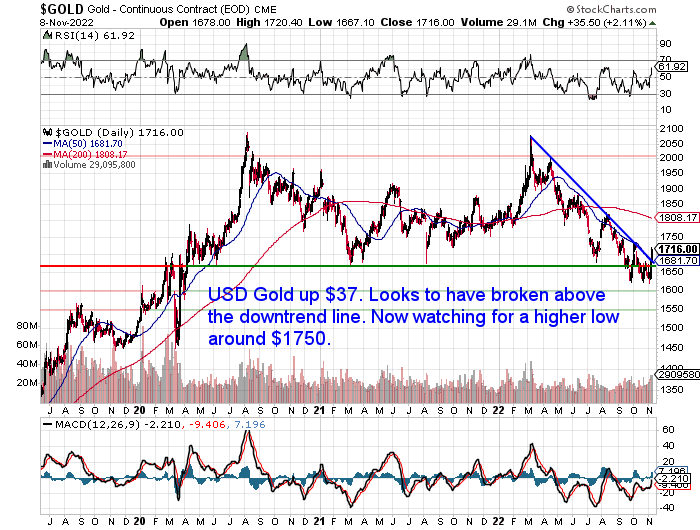

USD gold is up by virtually 5% from every week in the past. It has damaged above the downtrend line. However we now must see it make the next excessive above $1750 to substantiate this isn’t only a fakeout.

NZD Silver Surges over 6.5%

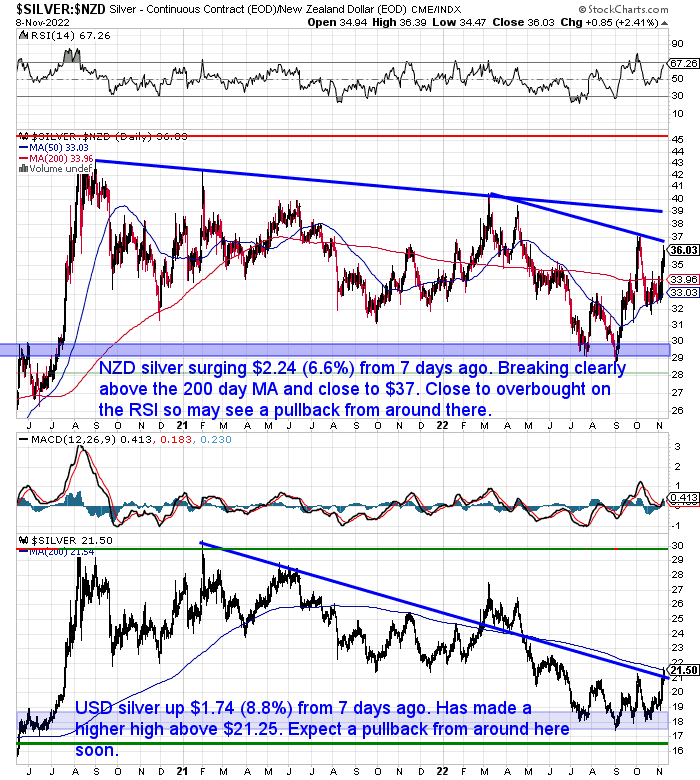

Silver in New Zealand {dollars} has surged even stronger than gold. It’s up by $2.24 from every week in the past or a hefty 6.6%. NZD silver is clearly again above the 200 day transferring common (MA) and now just under the excessive from early October. Nevertheless it’s near overbought on the RSI so we may count on a pullback from across the $37 mark. Silver continues its 2 yr sideways sample. We have to see it get again above $39 to interrupt out.

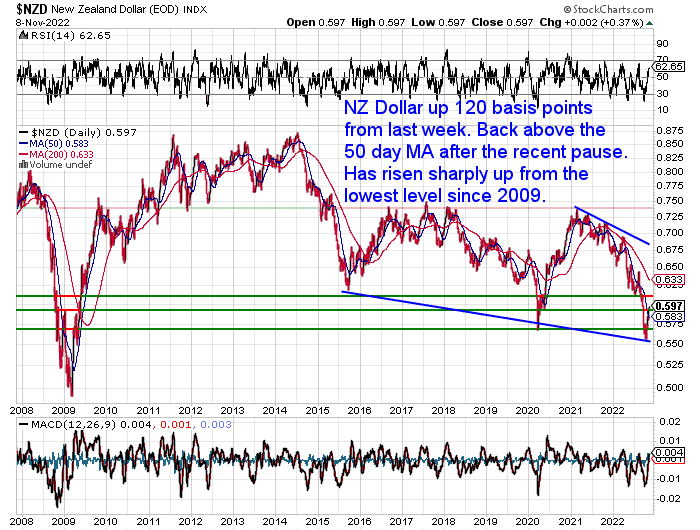

New Zealand Greenback Up 2%

The Kiwi greenback is up 120 foundation factors or 2% from 7 days in the past. It’s again above the 50 day MA after its current pause. Having risen sharply from its lowest degree since 2009. However may run slightly increased but too.

Want Assist Understanding the Charts?

Try this put up if any of the phrases we use when discussing the gold, silver and NZ Greenback charts are unknown to you:

Continues beneath

Lengthy Life Emergency Meals – Again in Inventory

These straightforward to hold and retailer buckets imply you gained’t have to fret in regards to the cabinets being naked…

Free Transport NZ Vast*

Get Peace of Thoughts For Your Household NOW….

—–

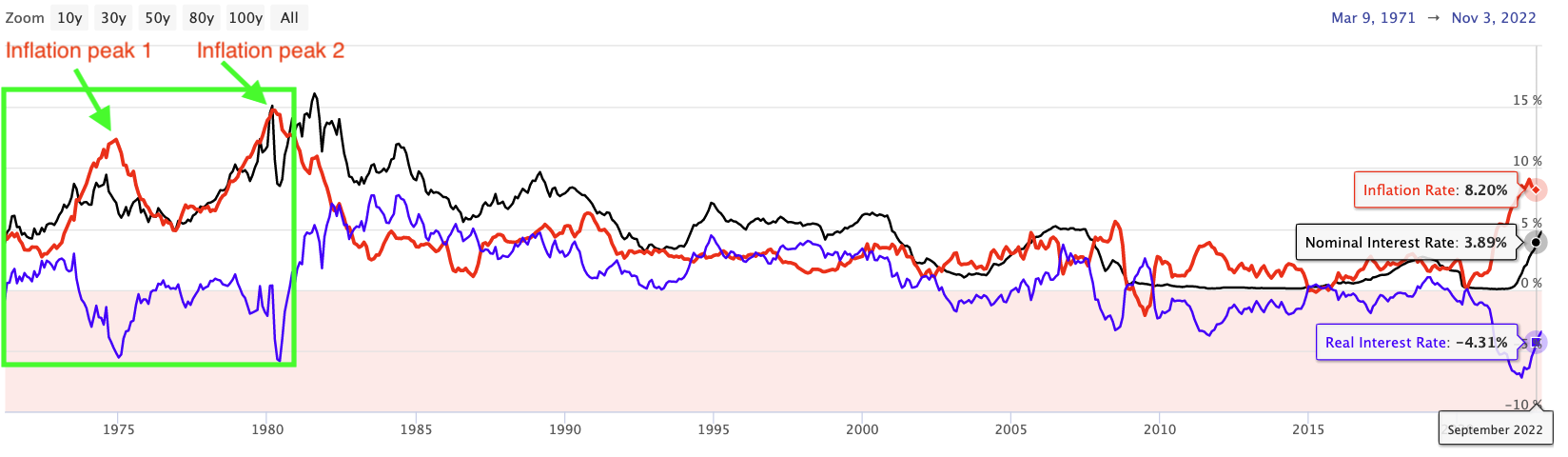

1970’s and Double Peak of Inflation

Final week we requested the query: “Will We See A number of Waves of Inflation?”

“Now we have by no means had inflation working at present ranges with out experiencing a so-called double prime inflation regime. That was the case in 1974-1980 and in 1946-1951. The reason being easy. As quickly as disinflationary traits get clearer and clearer, everyone (together with politicians) might be screaming on the Fed and the ECB to pivot. Central banks will probably collapse beneath immense exterior strain, it doesn’t matter what they’re saying at present.”

This week we seen that US actual rates of interest have been rising since March. Though from a deeply detrimental degree. (Actual rates of interest are simply nominal or the central financial institution set rate of interest much less the speed of inflation). US actual charges received as little as -7.21% in March however have been on the up since then, nevertheless they continue to be very detrimental. This long run traits stay chart clearly exhibits this.

Supply.

That probably explains the behaviour of treasured metals since March too.

Right here is the chart of gold in US {dollars}. Gold has been falling since March, probably as a result of the route of actual rates of interest has been up.

The actual rates of interest chart above additionally highlights one other vital incidence within the 1970’s. See the inexperienced field. That exhibits a second peak in inflation which was increased than the primary one. That second peak additionally noticed one other peak in nominal rates of interest. Together with a second trough in actual rates of interest.

Or put one other approach. Inflation peaked in 1975 following which rates of interest have been lower. Resulting in an extra spike in inflation and an extra enhance in rates of interest. Whereas actual rates of interest initially rose however then fell again to a brand new low in 1980. Throughout this second inflationary peak (and conversely actual rate of interest trough) is in fact when treasured metals carried out at their finest.

So there’s each likelihood we may see an identical scenario play out on this cycle.

Ray Dalio’s Hedge Fund Bridgewater: “Prolonged interval of above-target inflation, and a second spherical of tightening”

A second peak state of affairs is precisely what Ray Dalio’s Bridgewater are warning of of their newest replace which is price studying in full. However here’s a key part [emphasis added is ours]:

“For the tightening to sustainably cut back inflation would require vital impacts on labor earnings. Labor earnings is the sum of two components, hours labored (dominated by headcount) and wages per hour. The tightening should first produce a contraction within the variety of folks working and lift the unemployment charge by sufficient and for a protracted sufficient time period to reverse the provision/demand imbalance for labor sufficiently to decrease the value of labor, i.e., wages. Solely after wage development slows will inflation stabilize on the ranges that central banks need and that the markets are discounting.

Up up to now, the suitable coverage response to the setting has been clear, although it got here too late. Sturdy development and the emergence of a self-reinforcing, excessive degree of inflation required a tightening. Going ahead, the coverage selections might be far tougher when the objectives of full employment and secure costs are at odds and the contraction in employment has not been sustained for lengthy sufficient to carry down wage development. For many central banks, at that stage there’s a tendency to pause and see how issues transpire. Such a pause tends to offer markets a celebratory reprieve, producing a interval of excellent asset returns and a pickup in development, each of which conspire to forestall wages and inflation from settling on the desired degree, which necessitates the subsequent spherical of tightening.

A near-term financial downturn, an prolonged interval of above-target inflation, and a second spherical of tightening should not discounted within the markets in any respect. What the markets are actually discounting is that the primary spherical of tightening is sort of over, that development is not going to gradual a lot and but inflation will rapidly fall to desired ranges and that this may enable a lower in rates of interest in 2023 and 2024 that restores a traditional threat premium in bonds. There’s a variety of room for markets to be blindsided by what we see as the traditional sequence of occasions which generally follows the situations that exist as we speak.”

Supply.

The bolded part above is precisely what occurred within the 1970’s. As talked about already that is clearly seen with the 2 inflation peaks in the true rates of interest chart above.

So What About Actual Curiosity Charges in New Zealand?

The above is discussing actual charges within the USA. How about right here within the land of the lengthy white cloud?

We’ve up to date our NZ actual rates of interest information after which in contrast this to gold on this week’s function put up. We cowl:

- How Do Actual Curiosity Charges Differ From the In a single day Money Charge (OCR) that the Reserve Financial institution Fiddles With?

- Why is the “After Inflation” Curiosity Charge So Essential?

- So What’s the Actual Curiosity Charge in New Zealand At the moment?

- How do you Calculate the Actual Curiosity Charge?

- The Relationship Between Gold and Actual Curiosity Charges

- However What if We Get Increased Inflation and So Curiosity Charges Begin to Rise?

- The place to Subsequent for Actual Curiosity Charges in New Zealand?

Your Questions Wished

Keep in mind, should you’ve received a selected query, you’ll want to ship it in to be within the working for a 1oz silver coin.

A Strong Argument as to Why Central Banks Received’t Tighten Onerous Sufficient and Lengthy Sufficient

Final week we additionally mentioned whether or not the Fed will “Wimp Out” and “Pivot”? That’s, will they cease their rate of interest will increase earlier than they’re at present making out they may?

David Stockman makes use of historical past to indicate us how troublesome it is going to be for present central bankers to aim a “Paul Volker” and crank rates of interest increased sufficient (and for lengthy sufficient) to tame inflation…

Captain Powell Tries To ‘Talk’

By David Stockman“…Volcker lastly broke the again of cost-push inflation by driving actual rates of interest to ranges which might be scarcely possible as we speak”.

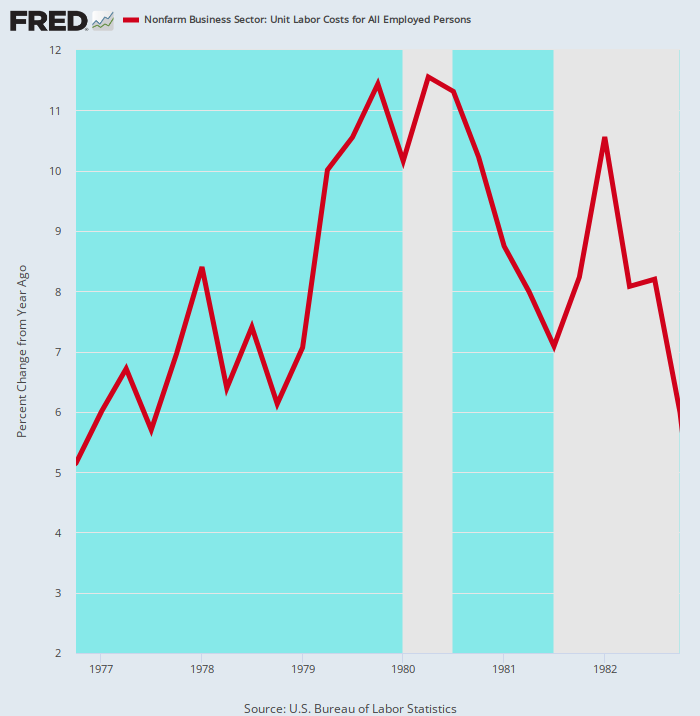

…it was not till early 1983 – after two recessions – that unit labor value development returned to its late 1976 degree. That’s to say, value push inflation proved to be “sticky” certainly.”

Y/Y Change In Unit Labor Prices, 1976 to 1982

For sure, Tall Paul Volcker didn’t break the again of cost-push inflation by coddling both Wall Road or commodity speculators. On the contrary, he drove actual rates of interest sky excessive, and solely then did the credit-fueled bubble of the Nineteen Seventies succumb to monetary stringency enough to reverse the inflationary momentum.

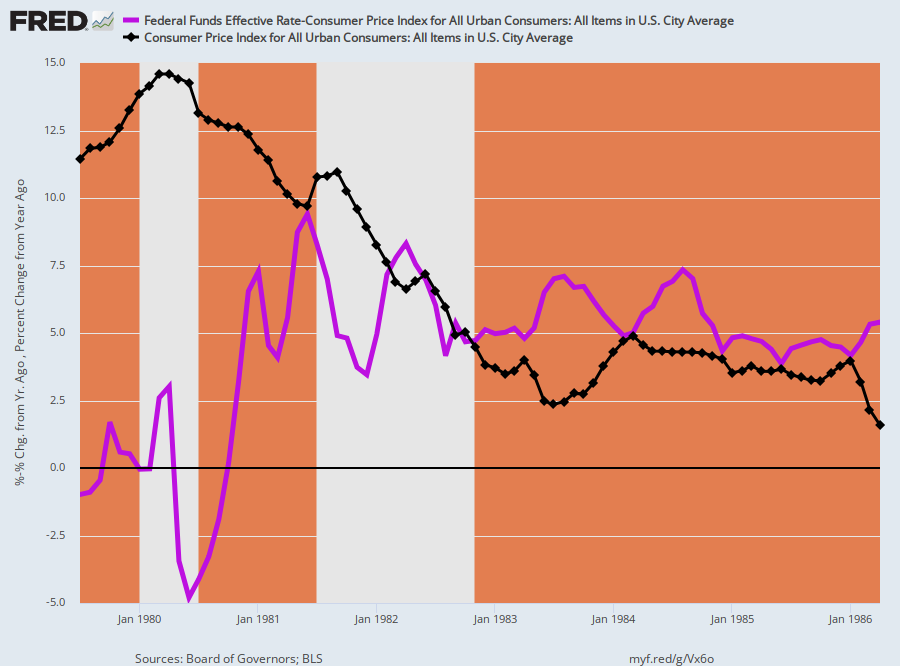

Thus, when Volcker took the helm in August 1979, the inflation-adjusted Fed funds charge (purple line) was barely detrimental, whereas the CPI (black line) was posting at a 11.5% Y/Y charge of enhance. So the Volcker Fed saved pushing nominal charges increased – at increments which far outpaced the present Fed will increase – till the true charge peaked at 9.4% in June 1981.

In wants be famous, nevertheless, that this sustained 23-month lengthy push increased occurred properly past the time that the CPI peaked at 14.6% Y/Y in March 1980. In actual fact, when Volcker lastly barely loosened the true charge 15-months later, the Y/Y CPI was already down by 500 foundation factors to 9.6%.

That’s to say, a one-third rollback of the inflationary tide had been deemed inadequate to justify a coverage “pivot”, thereby representing a degree of financial self-discipline that’s nearly unthinkable as we speak whether or not Powell is really a born-again inflation-fighter or not.

Actual Fed Funds Charge Versus Y/Y Change In CPI, 1979 to 1986

This will get us to the $9 trillion query. Does the newly hawkish Jay Powell have even a fraction of the gumption and endurance that Paul Volcker demonstrated 40 years in the past?

…..Anybody who presided over absolutely the madness of his first 5 years within the prime chair on the Eccles Constructing most likely can’t be trusted to see it by way of. In any case, when Powell was sworn in as Fed Chairman in January 2018, the Fed’s steadiness sheet stood at $4.439 trillion, the work of 15 chairmen over 104 years.

When he lastly blinked in March 2022 and started to reluctantly increase charges from the zero-bound the place that they had been hideously impaled, the steadiness sheet stood at $8.937 trillion.

So the maths of it speaks a thousand phrases. The acquire throughout Powell’s first 50-months was $4.298 trillion, a determine bigger than the money-printing whole of all of his predecessors mixed!”

Supply.

Onerous to argue with Stockman there. And Ray Dalio has been extra proper than most in recent times too.

We favour a purchase, stack and overlook method. Be sure you have sufficient gold and silver to cowl your self from these situations after which disguise it away and overlook about it for a number of years.

Get in contact you probably have any questions on silver or gold:

- Electronic mail: [email protected]

- Telephone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Store On-line with indicative pricing

— Ready for the sudden? —

By no means fear about protected ingesting water for you or your loved ones once more…

The Berkey Gravity Water Filter has been tried and examined within the harshest situations. Again and again confirmed to be efficient in offering protected ingesting water everywhere in the globe.

This filter will present you and your loved ones with over 22,700 litres of protected ingesting water. It’s easy, light-weight, straightforward to make use of, and really value efficient.

Store the Vary…

—–

Source link