Rates and Charts

Delighted brand-new year! We hope you handled to take pleasure in a long time off with friends and family.

Not excessive action over the low volume vacation duration so we’ll keep today’s e-mail extremely quick.

We’ll have our typical year in evaluation and forecasts for 2024 post all set for you next week. It’s constantly fascinating to recall and see how we made with our guesses.

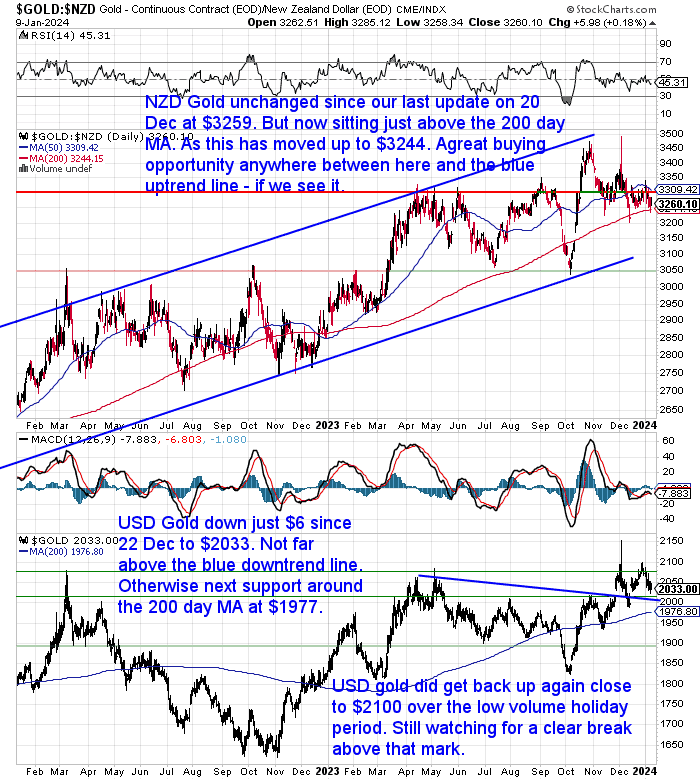

NZD Gold Unchanged From 3 Weeks Ago

Gold in New Zealand dollars is remarkably the same from our last weekly upgrade 3 weeks back on 20 December. It stays at $3259 and is now simply above the 200 day moving average (MA). Throughout that time it did return as much as the 50 day MA however didn’t prosper in getting any greater.

While USD gold performed in truth return to dabble the crucial $2100 level throughout the low volume vacation duration. However it is now down $6 considering that 20 December. Not far from the drop line. If that didn’t hold then the next assistance level is the 200 day MA at $1977. So we are still expecting a clear break above the $2100 mark.

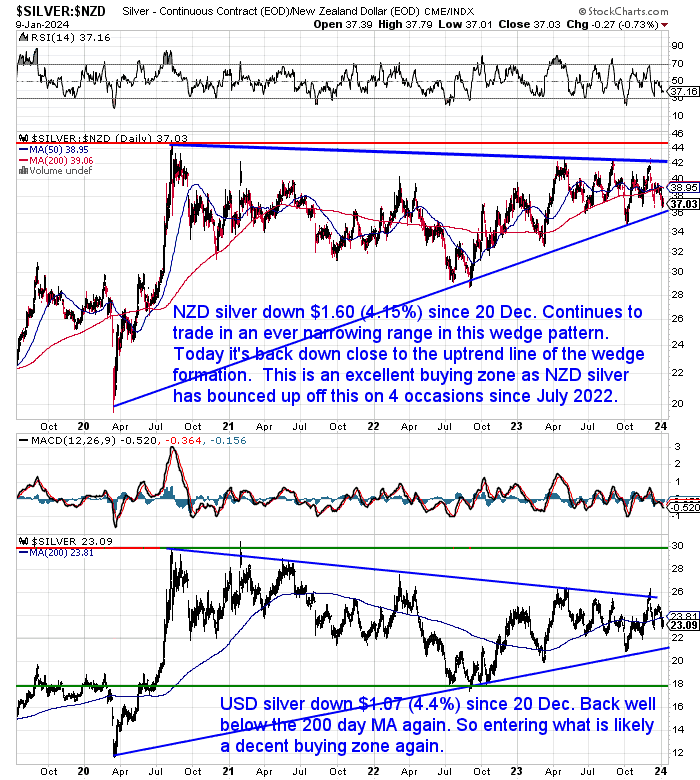

fifth Finest Time to Purchase Silver in NZD Considering That July 2022

Silver in New Zealand dollars is down a good $1.60 or over 4% considering that 20 December. It continues to sell the ever narrowing variety inside this combining triangle or wedge pattern that dates right back to 2020.

Today it is pull back near the blue uptrend line in the wedge. NZD silver has actually bounced off this line 4 times in the last 19 months. So by our numeration that makes now the 5th finest time to purchase NZD silver considering that July 2022. With the RSI closing in on oversold (listed below 30) that likewise includes credence to this theory.

So if you have actually been pussyfooting, now may simply be a great time to a minimum of put one foot down and buy of silver. As this uptrend line has actually held extremely strong for several years now.

In USD terms, silver is back listed below the 200 day MA however still above the uptrend line. So not rather such a strong buy signal there, however still in what is most likely to be a good purchasing zone.

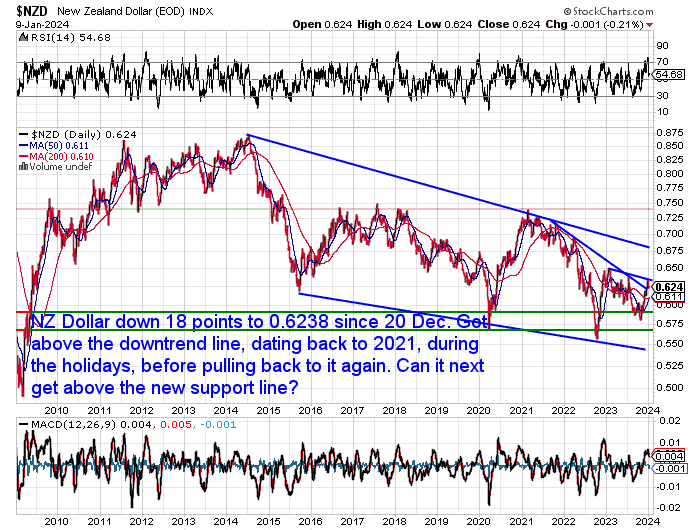

Kiwi Dollar Broke Greater

The New Zealand dollar is down 18 basis indicate 0.6238 considering that December 20th. It broke above the drop line going back to 2021 over the vacations. However has actually drawn back to retest that once again. Now the concern is can it return above the brand-new assistance line from the start of 2023?

Nevertheless we’ll still require to see it break the horizontal resistance line at 0.6500 and make a greater high, before we’ll be more particular of a modification in pattern.

Required Assistance Comprehending the Charts?

Have a look at this post if any of the terms we utilize when going over the gold, silver and NZ Dollar charts are unidentified to you:

Continues listed below

Long Life Emergency Situation Food– in Stock

These simple to bring and keep pails suggest you will not need to fret about the racks being bare …

Free Shipping NZ Wide *

Get Assurance For Your Household NOW …

—-

Simply a reprint of our last post from 2023 in case you missed it:

Your Concerns Desired

Keep In Mind, if you have actually got a particular concern, make certain to send it in to be in the running for a 1oz silver coin.

We’re back to typical operations today. With all items readily available to purchase and deliveries resuming too.

So please contact us for a quote for silver or gold or if you have any concerns:

- Email: [email protected]

- Phone: 0800 888 GOLD (0800 888 465) (or +64 9 2813898)

- or Store Online with a sign rates

— Gotten ready for the unforeseen?–

Never ever fret about safe drinking water for you or your household once again …

The Berkey Gravity Water Filter has actually been attempted and checked in the harshest conditions. Time and once again shown to be reliable in offering safe drinking water all over the world.

This filter will supply you and your household with over 22,700 liters of safe drinking water. It’s basic, light-weight, simple to utilize, and extremely affordable.

Store the Variety …

—-

Source link