Foll owing the 2009 monetary crisis, the term derivatives has actually been strongly embedded in todays lexicon.

With the failure of Bear Stearns in 2008, and subsequent bailout of numerous other too huge too stop working banks, the term “acquired” was turning up all over. Then in 2012 we had JP Morgan’s $7 billion trading loss on credit derivatives in the news.

In 2019 there was still a lot of conversation over Deutsche Banks acquired portfolio and the threats this put on the international monetary system. With great factor too. Here’s a terrific summary from Wall Street on Parade:

The great void surrounding derivatives is simply as dark today as it remained in 2008– and simply as unsafe. The Financial Crisis Questions Commission had this to state about the crash: “the presence of countless derivatives agreements of all types in between systemically crucial banks– hidden and unidentified in this uncontrolled market– contributed to unpredictability and intensified panic, assisting to speed up federal government support to those organizations.” There is not one Federal or state regulator today who might inform you which counterparty has the most focused danger to derivatives. Nor exists one Wall Street bank who has clearness on this concern– since most of the non-prescription acquired agreements are secret agreements in between one celebration and another.

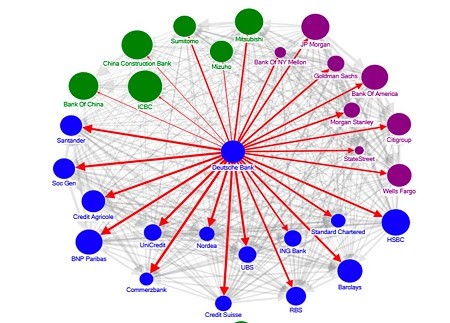

We understand that Deutsche Bank’s acquired arms extend into the majority of the significant Wall Street banks. According to a 2016 report from the International Monetary Fund (IMF), Deutsche Bank is greatly adjoined economically to JPMorgan Chase, Citigroup, Goldman Sachs, Morgan Stanley and Bank of America along with other mega banks in Europe. The IMF concluded that Deutsche Bank postured a higher risk to international monetary stability than any other bank as an outcome of these affiliations– which was when its market capitalization was 10s of billions of dollars bigger than it is today.

Up until these mega banks are separated, till the Fed is changed by a skilled and major regulator of bank holding business, and till derivatives are limited to those that trade on a transparent exchange, the next legendary monetary crash is simply one counterparty blowup away.

Source.

Source: IMF– Banks are all adjoined. So there is a danger of contagion. In 2016, the IMF thought about Deutsche bank the ‘crucial net factor to systemic threats in the international banking system.’ Since it is related to a many global organizations in the monetary system.

Frightening things. However have you ever stopped to believe exactly what derivatives are, how do they work, and what threats do they bring?

Today we’ll attempt to uncover why Warren Buffet described them ” monetary weapons of mass damage” and cover …

What is a Derivative?

To begin with a meaning might be a great location to begin. From the lazy reseachers’s dictionary wikipedia:

Acquired: An acquired instrument is an agreement in between 2 celebrations that defines conditions (specifically the dates, resulting worths of the underlying variables, and notional quantities) under which payments are to be made in between the celebrations;

So they are monetary instruments whose worths depend upon the worth of other underlying monetary instruments or things. Instruments such as products, equities (shares), domestic or business home mortgages, bonds, rates of interest, or currency exchange rate. They can take the kind of futures, forwards, choices and swaps.

The History and Origin of Derivatives

The history of derivatives go back to the 1800’s. Where derivatives were utilized to hedge farmed products, provided these are impacted by numerous variables and have an unidentified ultimate price.

So rather of Farmer Joe doing his planting, growing and collecting. Then hoping he ‘d have a crop of a particular size that he might offer, for a particular rate to earn a profit. He was now able to– for a relatively little cost– ensure a set earnings at a defined date in the “future” for his crop. So started the Futures markets.

Offering some level of predictability to farming earnings was extremely advantageous. It made it possible for development and improvement in lots of other sectors which ultimately caused the commercial transformation.

So derivatives have their location as they have had lots of favorable effect on humankind because their creation.

Derivatives Morph: From Farmers Pal to Financial Defense of Mass Damage

Nevertheless in the 2 centuries that have actually passed ever since, derivatives have actually changed into something looking like a monetary gambling establishment. A gambling establishment where a couple of significant gamers really manage 92% of the markets derivatives.

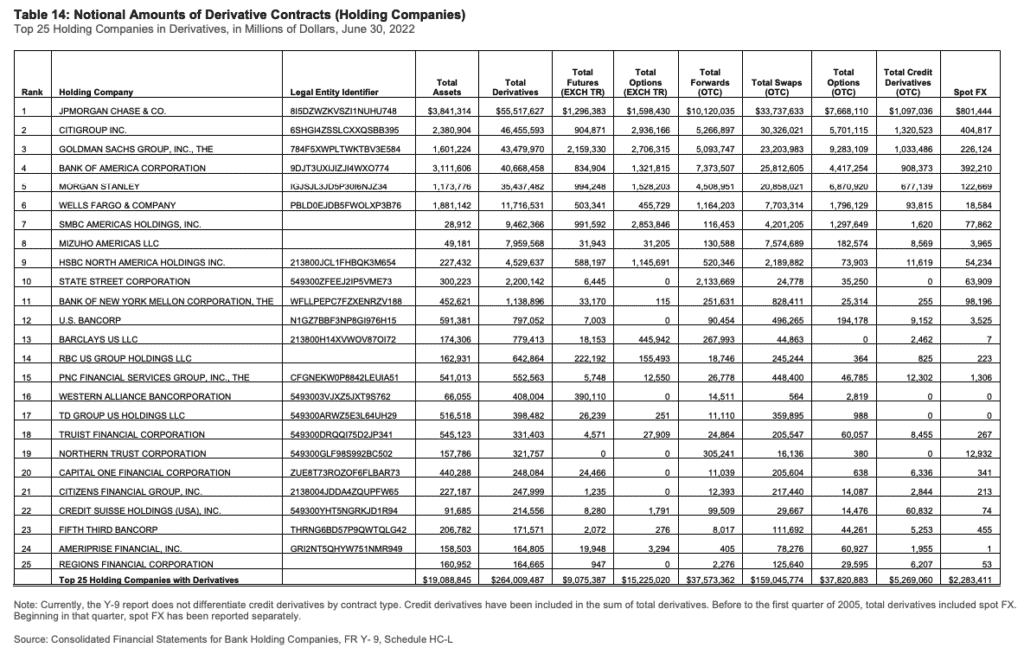

As at 30 June 2022, 7 primary banks whose names will not amaze you, hold $243 trillion of the $264 trillion held by the leading 25 United States business: J.P. Morgan Chase & & Co, Citigroup, Goldman Sachs, Bank of America, Morgan Stanley, Wells Fargo and SMBC Americas Holdings, INC).

Source: Quarterly Report on Bank Trading and Derivatives Activities 30 June 2022– United States Workplace of the Comptroller of the Currency

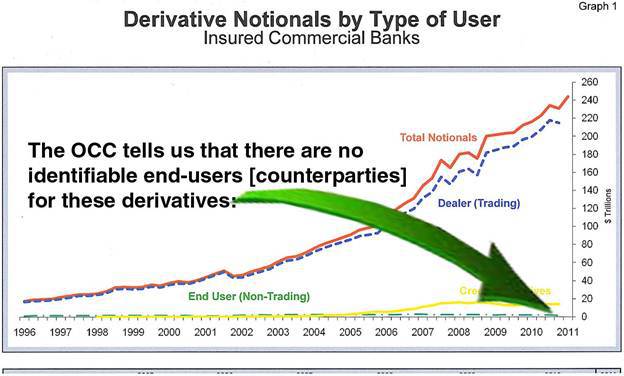

The chart listed below demonstrate how little a portion of derivatives are held by real end users (green line) seeking to hedge themselves. Versus simply traded by the similarity the above 7 banks (blue line).

( For a visual representation of the freakish size of these banks acquired books see this fantastic infographic: Demonocracy.info– Derivatives: The Uncontrolled International Gambling Establishment for Banks)

Source

Rob Kirby provides an in-depth introduction of the complete history of derivatives if you desire all the holes filled out here.

Rates Of Interest Swaps are the Dominant Acquired

Apart from the enormous modification in traders versus end users that can be seen in the chart, the other significant modification in the previous 20 or two years was the introduction of the “rates of interest swap”.

It’s extensively gone over that credit derivatives (i.e. derivatives of loans/mortgages) were the reason for the 2008 monetary crisis. Surprisingly, it is really rates of interest swaps with a notional worth of $475 Trillion that comprise practically 80% of the overall acquired swimming pool of $598 Trillion (as reported by the Bank of International Settlements year for the ending 2021 (BIS)

Look once again at the chart above and you can see the percentage that credit derivatives comprise. The yellow line represents credit derivatives versus the overall notional derivatives in red.( Note: the chart just increases till 2011. However the percentage in between these various kinds of derivatives has actually remained fairly constant ever since).

Why Do Rates Of Interest Derivatives Now Comprise A Lot of the Overall?

Since as Rob Kirby states, it is these rates of interest swaps which permit the United States Fed/Treasury to manage or control the “rate of cash”, that is the long term United States treasury rates of interest.

In times passed Bond Vigilantes (no they didn’t take the political leaders into the street and hang them by their necks!) would offer federal government bonds. For that reason driving rates of interest up when federal governments were spending too much.

Efficiently the vigilantes would be stating to federal governments, “We do not trust your capability to pay back so we are offering your bonds and for that reason you need to pay a greater rate to draw in another purchaser of your financial obligation.”

This no longer happens as shown by Expense Gross’s PIMCO Mutual fund offering out of its enormous stake of United States treasuries in March 2011. The treasury rates of interest then immediately plunged, simply the reverse of what you ‘d anticipate.

To be truthful the procedure through which the United States Exchange Stabilisation (Fund ESF) controls the treasury rates of interest is quite made complex.

I’m unsure we can sum up and make it any easier than Rob Kirby’s post (which we have actually gotten much insight from). So listed below is an extract from that: (Otherwise simply stick to “they produce the need out of thin air” and you will not be too far from incorrect!):

“++ The ESF takes part in these trades taking “NAKED RATE OF INTEREST THREAT”– indicating they do not supply their counterparties with the requisite quantity of bonds to hedge their trades– therefore requiring them into the “free enterprise” to buy them. This creates UNBELIEVABLE “stealth” settlement need for U.S. Federal government securities. This is how/why U.S. Federal government bonds and for this reason the Dollar can be made to appear “bid-unlimited”– even when financial principles are shrieking otherwise. The quantity of need for money federal government bonds that can be conjured out-of-thin-air in the acquired rates of interest swap complex, which may be finest referred to as “high-frequency-trade” on steroids– determined in numerous Trillions in notional– actually OVERWHELMS the money bond settlement procedure. This implies bond yields are set arbitrarily– in accordance with Fed/ Treasury policy– NOT IN FREE MARKETS. This likewise discusses why there are no recognizable end-users for the excessive development in rates of interest derivatives [swaps]– the trade is all attributable to the Treasury’s ‘unnoticeable’ ESF– an organization that is not openly responsible to anybody or ANYTHING. This is why other countries can and do have, from time to time, stopped working bond auctions while America never ever has and NEVER WILL MAY TO. This is all carried out in stealth to assist in and offer an air of authenticity to the U.S. Treasury’s ZIRP [zero interest rate policy].”

Source.

So this is how they handled to keep rates of interest repaired near to no in the United States in the after-effects of the monetary crisis and through till this previous year.

Rates Of Interest Derivatives Might be the Source of Huge Difficulty

Back in December 2011, the BIS information revealed that $184 trillion of rates of interest derivatives remained in Euros. While just $161 trillion remained in United States dollars.

In the years because the worth of United States denominated rates of interest derivatives has actually grown to $169 Trillion. While in Euro’s these have actually dipped to $114 Trillion.

So consider that most banks obtain brief however have big loan books at repaired rates for extended periods. For that reason a huge increase in rates of interest might activate claims on these rates of interest derivatives.( Hat suggestion to Alf Field for this point).

Alf Field (who we delighted in listening to at the 2011 Gold Seminar in Sydney) mentioned back in 2012:

Crikey!” If simply 10% of the rates of interest derivatives in Euro’s fruit and vegetables losses, the world’s banking system would be looking down the barrel of a loss of $22 trillion. That suffices to bankrupt the whole world’s banking system, something that the political leaders of the world might not endure. What would a bail out of $22 trillion do to monetary markets? What would it do to the gold rate? If it is not rates of interest, there are $64 trillion of forex derivatives and a “simple” $32 trillion of credit default swaps exceptional that might produce “black swan” surprises.”

2022 Rates Of Interest Increases Triggering Issues?

Maybe with the boost in rates of interest over the previous year we are beginning to see some issues with these rates of interest derivatives?

Here’s some current news products following current concerns in the U.K. Pension markets:

” Essentially pension appear to have actually been captured in doom-loop of margin contacts rates of interest derivatives that required them into discarding longer-maturity UK gilts, and stimulated the Bank of England into stepping in today.” https://t.co/YSvVPEvsI7

— Pedro da Costa (@pdacosta) September 28, 2022

Did the severe relocations in rates and Fx simply light this fuse? https://t.co/4bh5FL131A

— Lawrence Lepard, “repair the cash, repair the world” (@LawrenceLepard) September 29, 2022

It appears the UK and by extension the international monetary system was under extreme pressure due to pension funds’ rates of interest derivatives collapsing in worth after the UK Budget Plan …

” Pension funds are internationally on the edge of collapse due to increasing rates of interest and insolvency danger. In order to produce capital, the pension funds have actually developed rates of interest swaps. However as bond rates rose these swaps collapsed in worth, needing either liquidation or margin injection.

And therefore the Bank of England needed to support the UK pension funds and monetary system to the degree of ₤ 65 billion to prevent default.

In the last number of weeks we have actually seen a depressing circumstance in Switzerland. Swiss banks, through the Swiss National Bank (SNB) have actually gotten $11 billion continuous assistance through currency swaps (a type of dollar loans) from the Fed.

No information have actually been exposed of the Swiss circumstance other than that 17 banks are included. It might likewise be global banks. However many definitely the ailing Credit Suisse is included.

What is clear is that these UK and Swiss scenarios are simply the suggestion of the iceberg.

The world is now on the edge of another Lehman minute which might appear at any time.”

Source.

What Do These Derivatives Mean for New Zealand?

So how does all this impact little old New Zealand on the other side of the world? Well, bankrupting the whole world’s monetary system does not sound too great to us. Do not believe our location will always assist us excessive on that one.

However we might likewise have some derivatives of our own to stress over closer to house.

In early 2102 we came across this report. Where an Australian financial expert, Partner Teacher Dr Sue Newberry, stated that New Zealand federal government accounts disregard “off-balance sheet direct exposures” totaling up to more than $112 billion (focus included is ours).

” There has actually been a considerable boost in the federal government’s activity in monetary markets over the previous years, she stated. Nevertheless, the federal government’s accounts do disappoint that plainly.

” What takes place if you do reveal the degree of direct exposures to derivatives is truly rather enormous,” she stated.”

Derivatives are both a property and a liability. Newberry stated the method these are represented is by netting these off instead of revealing the overalls of each. Nevertheless, the risks of derivatives were exposed in the international monetary crisis because one side of an agreement can collapse while the opposite stays in force. “Netting off obscures that,” she stated.

[She] stated embracing “Usually Accepted Accounting Practice” requirements is camouflaging the quick development in monetary market activities and the degree of the federal government’s direct exposures.”

The point we have actually highlighted is a great one and one that appears to be disregarded by the facility. The enormous size of the international acquired tower is frequently rationalized by stating they “net” each other out.

Anyhow back to New Zealand, a treasury representative stated in reply to Dr Newberry:

” Derivatives with the Financial Obligation Management Workplace (NZDMO) generally include rates of interest and cross currency swaps [hhhmmm sound familiar???] utilized to handle threats connected with either financial obligation issuance or with fixed-income possession purchases. The workplace likewise performs derivatives with other parts of the Crown.

” NZDMO tends to handle danger connected with these trades by negotiating with the economic sector. The other Crown entities utilize the trades with NZDMO as hedges for their own threats,” it stated. Nevertheless, to get a total image of derivatives utilized would need speaking with all entities included.

Delegation to negotiate undergoes controls and handled by proficient specialists, Treasury stated.

” These specialists act within transparent danger policies and specifications and are responsible for their efforts and should satisfy comprehensive reporting standards and structures.”

Not exactly sure just how much the truth they are “handled by proficient specialists” makes us feel much better!$ 112 Billion appears quite considerable to us to be “off book”. Think about that NZ’s gdp in 2012 was around $202 Billion, this off book acquired figure total up to over half that figure!

We’re no forensic accounting professionals however that number even if just half ideal appears frightening to us. However most likely every other nation utilizes comparable accounting approaches, so what’s the huge offer?!! Who understands precisely what these numbers suggest, however that is the point with derivatives– nobody truly understands what their effect will be as this is all brand-new area.

NZ Bank Derivatives Have Grown Too

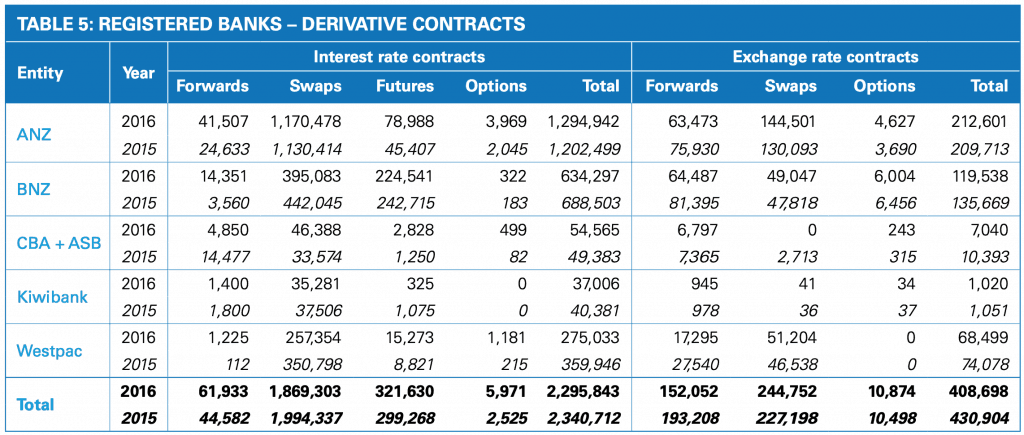

The derivatives held by New Zealand Banks, especially rates of interest derivatives, have actually grown considerably recently too:

” Derivatives agreements held by New Zealand’s significant banks rose in worth by 38.5% in the year to September 30, 2015.

A chart in KPMG’s yearly Financial Institutions Efficiency Study reveals derivatives agreements held by the nation’s huge 5 banks increased by $770.3 billion, or 38.5%, to to $2.77 trillion. Rate of interest agreements consisted of the lion’s share, leaping 48% to $2.34 trillion.

At $1.2 trillion, ANZ holds simply over half all the rates of interest agreements with a huge yearly dive in rates of interest swap agreements tape-recorded year-on-year. ANZ likewise holds the most significant piece of the combined $430.9 billion of currency exchange rate agreements, although ANZ’s share dropped 6% to $209.713 billion.

All up, ANZ NZ had $1.4 trillion worth of derivatives held for trading since September 30 in 2015, which was completion of the bank’s fiscal year.”

Source.

The most current KPMG Financial Institutions Efficiency Study does not appear to include any acquired positions information. The most current we might discover was from 2016 as revealed listed below:

Source.

So bank acquired positions lowered ever so somewhat in the year 2016 from 2015. However simply as it remains in the U.S.A., the overall size of derivatives held by New Zealand Banks is still substantial in contrast to the New Zealand banking system itself. Overall derivatives in 2016 were $2.71 Trillion, compared to overall properties of $456 billion for the leading 5 banks.

How to Secure Yourself from Acquired Danger?

As Rob Kirby commented in the post we referenced previously, physical rare-earth elements are “the achilles heel” of monetary scams. And if all the above isn’t factor enough to eliminate some paper currency from within the controlled monetary system and exchange it for physical gold and silver we do not understand what is!

Since physical gold and silver are the only monetary properties without any counter-party danger. Suggesting you are not trusting the solvency of somebody else for your possession to preserve its worth.

For 14 other factors to purchase gold see: Why Purchase Gold? Here’s 14 Factors to Purchase Gold Now

If you’re seeking to purchase silver or gold bullion and you want to see what items are readily available, go here: Purchase Silver Or Gold Online Store

You might likewise wish to take a look at this post to aid with picking what silver or gold to purchase: PAMP Suisse Gold/ Silver vs Regional NZ Gold/ Silver: Which should I purchase?

Source link