It ‘s time for our yearly evaluation of the efficiency of gold and silver in New Zealand dollars. We’ll likewise review our forecasts from the start of 2022. Then round off by making a couple of guesses regarding what 2023 may keep in shop for us …

Approximated reading time: 8 minutes

2022 was an awful year for the majority of financial investment classes. For numerous possession classes such as United States shares it was the worst year because 2008. Just conserved by an end of year rally to moisten the losses in the Dow Jones and S&P indices.

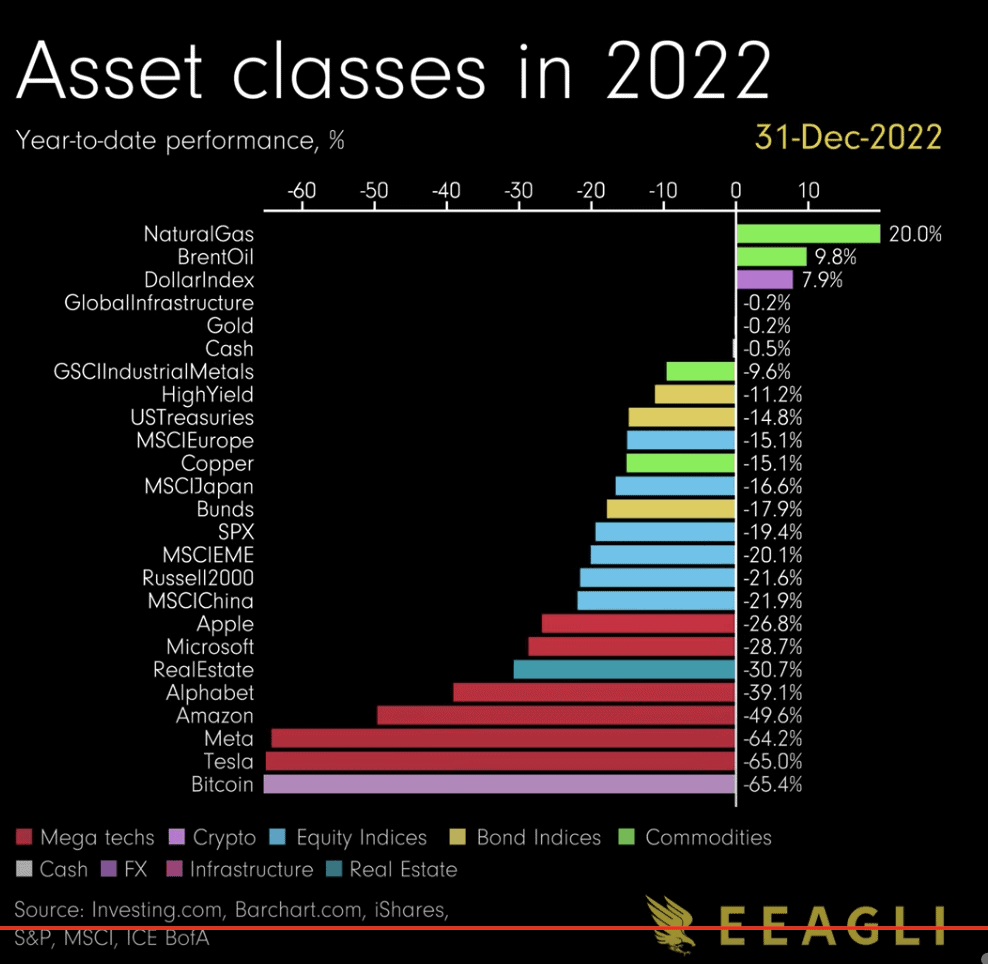

Here’s an excellent table care of James Eagle that reveals the efficiency of numerous possession classes for 2022. You can view an exceptional animated variation of it here to see how this altered as the year advanced.

You’ll see our possession of interest gold was near the top of the chart for 2022. Bitcoin was at the bottom, a total turnaround of the year prior to. Even the expected security of United States treasury bonds was down 15%.

Discover More about our favored approach of purchasing bitcoin and cryptocurrencies here.

However the above table takes a look at gold and silver in United States dollars. As we remain in New Zealand we ought to track the NZ dollar gold and silver cost, not the United States dollar cost. So how how did rare-earth elements fare in 2022 in New Zealand Dollar terms?

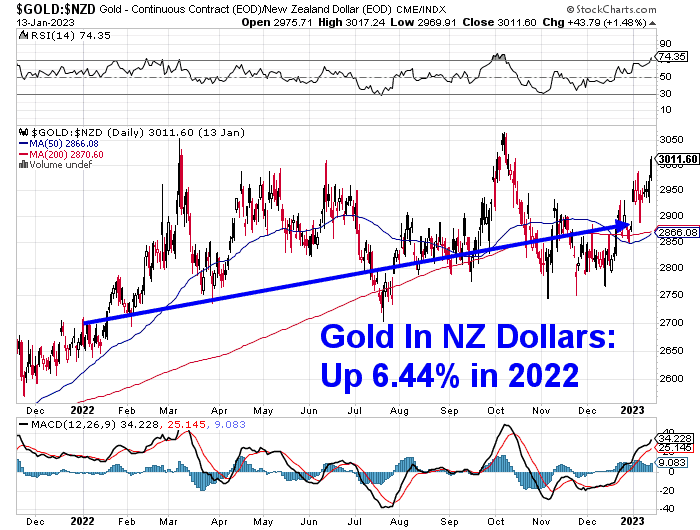

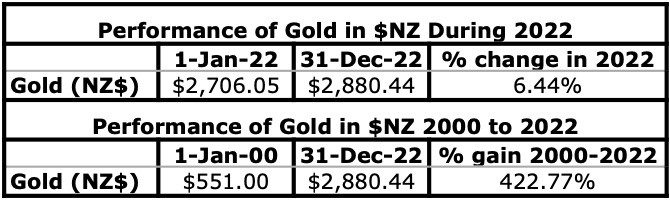

Gold in $NZ– Efficiency Throughout 2022

The chart for gold in New Zealand dollars reveals that unlike gold in United States dollars, which was flat for 2022, NZD gold was really up practically 6.5% for the year.

NZD gold increased highly at the start of 2022. Increasing from $2700 approximately $3050 by March. However it then invested the rest of 2022 zig-zagging sideways to complete the year in about the middle of this sideways trading variety. This pattern has actually continued for the very first number of the weeks of the year with gold leaping over $100 even more. It seems surrounding the 2022 high at $3050.

Recalling to the start of the centuries, gold is now up a good 422.77%.

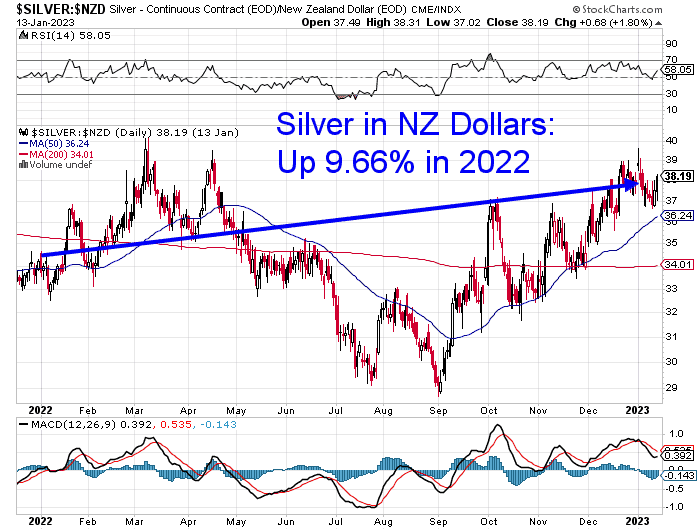

Silver in $NZ– Efficiency Throughout 2022

2022 saw silver outperform gold. Silver in NZ dollars was up practically 10% throughout 2022. This remained in plain contrast to 2021 when NZD silver was down 8%.

Simply as it did back in 2021, in 2015 NZD silver bottomed out in late September at simply listed below NZ$ 29 per ounce. To our eye it appears like silver is back in an uptrend because that bottom. Now we are enjoying to see if silver can get above the 2022 high of $40 this year.

Over the a lot longer term silver likewise has really underperformed gold. With silver up 267% because the year 2000. This is not a surprise truly. As previous booming market reveal that silver makes a great deal of gains in a brief time period. So the significant gains might come towards the tail end of this existing rare-earth elements booming market.

How Did We Opt for Our 2022 Forecasts?

Now, let’s see how precise we are with our 2022 forecasts or possibly more properly “guesses”? No point making any if we do not have a look back!

Here were our 2022 forecasts:

1. In 2019 and 2020 gold and silver had a number of excellent years. So we think with hindsight it wasn’t a huge surprise that 2021 saw them relax. For that reason we’ll state that gold and silver will complete 2022 greater than they began them So we’re not copying and pasting ins 2015 we’ll likewise forecast that they will both have double digit increases So the booming market was simply on time out in 2015 and ought to get better in 2022.

With gold up 6.44% that was single figures. Nevertheless with silver up 9.44% in 2022, that is extremely near to double digits. So we got that both were up for a half mark. However still perhaps we could score ourselves 0.6 out of 1 for this one?

2. Unlike 2021, silver will exceed gold in 2022.

Right on that a person with silver up 9.44% compared to gold’s increase of 6.44%.

3. Inflation will not simply be “short-term”. We’ll see high inflation continue throughout 2022.

Yearly inflation in NZ determined by the CPI in September 2022 was 7.2%. So that definitely wasn’t short-term. With hindsight that a person now appears extremely apparent. However bear in mind that throughout 2021 reserve banks and bank economic experts were still anticipating that inflation was simply a short-lived blip triggered by covid shut downs. So another point there too.

4. 2022 will lastly see a stock exchange fall with a bearishness correction (i.e higher than 20%). (Hat pointer to our secret financial investment consultant for this one) This will come as total surprise to numerous, as main organizers have actually gotten everybody so utilized to seeing whatever increase.

We ‘d need to provide ourselves a tick for that a person too. The S&P 500 index was down 19.44% since completion of 2022. However throughout the year it fell by as much as 24%. So that was a fall of over 20% throughout the year so that pleases the meaning of a bearishness in United States stocks. Rating one there too.

5. Reserve banks will trigger the stock exchange crash by withdrawal of stimulus. So we will see them without delay reverse course and pump more back into worldwide economies. Thus genuine rate of interest will continue to be unfavorable.

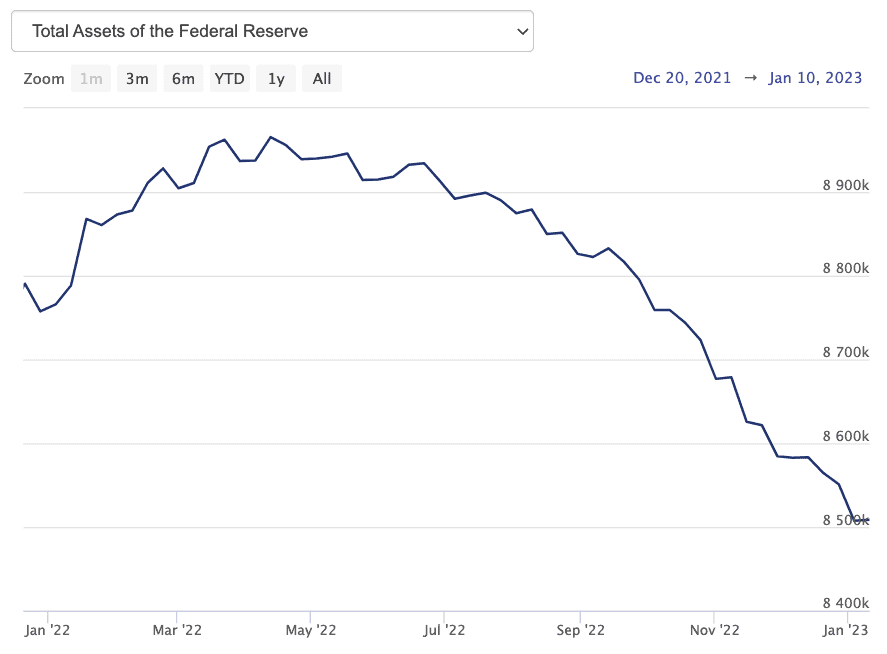

Reserve banks have actually continued to raise rate of interest and the United States reserve bank has actually likewise decreased its balance sheet throughout 2022.

The balance sheet decrease in specific most likely contributed in share markets falling throughout the year. Nevertheless we are yet to see Reserve banks reverse course and pump more liquidity into the system. Although genuine (after inflation) rate of interest have actually continued to be unfavorable throughout 2022. Since in spite of reserve banks raising rate of interest, inflation has actually stayed greater than these rates. So we’ll mark ourselves hard there and state half a mark, despite the fact that perhaps we were 2/3 on this one.

So total we can be found in with a 4.1 out of 5. Far better than the year prior to. Maybe we’ll provide Nostradamus a run for his cash yet! However as we state these are simply punts we produce the enjoyable of it more than anything.

Our Forecasts (Guesses!) for 2023

Now what about our forecasts for 2023? Here’s what we have actually seen in the crystal ball and tea leaves for this year …

- We’ll once again state that NZD priced gold and silver will complete 2023 greater than they began them Nevertheless we’ll likewise state that their increase will be smaller sized than that of gold and silver in United States dollars.

- The New Zealand dollar will be up versus the United States Dollar for 2023. The pattern that began in October 2022 is most likely to continue this year. Although perhaps not with such strength. So we’ll state more of a mild increase for 2023.

- We are beginning to see talk of inflation having actually peaked with reports out today. Nevertheless we believe high inflation rates are here for a variety of years to come yet. We anticipate inflation to continue to hover around comparable levels to 2022.

- 2023 will likewise see stock exchange continue to fall. Both the United States S&P 500 and the NZX50 will complete the year lower than they began. The tech heavy NASDAQ might continue to drop greatly. Possibly we’ll see that fall another 20%?

That is 4 forecasts for 2023. The more forecasts you make, the more space you need to be incorrect! So we’ll see whether we can have as much luck this year as we did last. It’s infamously challenging to forecast the marketplaces over a specified timeframe. A much better bet is to utilize dollar expense averaging and make routine purchases of gold and silver throughout the year.

Or utilize some technical signs to time your purchases after a draw back in the rare-earth element rates.

Gold and silver are up because the start of 2023. So register to our day-to-day cost informs if you wish to hear when other draw back take place throughout the year.

Source link