By Swann Collins, financier, author and specialist in worldwide affairs– Eurasia Company News, February 1, 2023

Gigantic reserve bank purchases, assisted by energetic retail financier purchasing and slower gold ETF outflows, raised yearly need of the yellow metal to an 11-year high

Yearly gold need (leaving out OTC) leapt 18% in 2022 to 4,741 t, a record given that 2011– a time of remarkable financial investment need, reported on January 31 the World Gold Council. The strong full-year overall was assisted by record Q4 need of 1,337 t of gold.

Gold jewellery usage softened a portion in 2022, down by 3% at 2,086 t. Much of the weak point came through in the 4th quarter as the gold cost rose amidst persistant high inflation given that summertime 2021 and the geopolitical crisis in Europe.

Financial investment need for gold (leaving out OTC) reached 1,107 t (+10%) in 2022. Need for gold bars and coins grew 2% to 1,217 t, while holdings of gold ETFs fell by a smaller sized quantity than in 2021 (-110 t vs. -189 t), which even more added to overall financial investment development. Quarterly changes in OTC need mostly netted out throughout the years.

A 2nd successive quarter of substantial reserve bank need (417t) took yearly purchasing in the sector to a 55-year high of 1,136 t, most of which was unreported.

Need for gold in innovation saw a sharp Q4 drop, leading to a full-year decrease of 7%. Degrading international financial conditions obstructed need for customer electronic devices.

Overall yearly gold supply increased by 2% in 2022, to 4,755 t. Mine production inched as much as a four-year high of 3,612 t.

Emphasizes

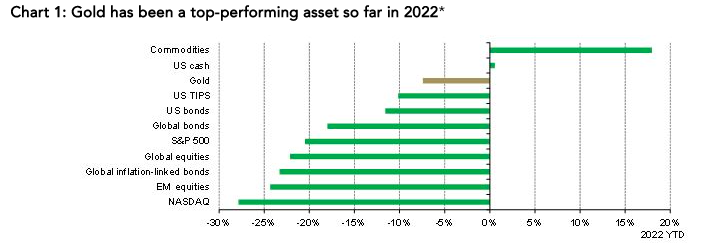

The World Gold Council reported that 2022 saw a record yearly typical LBMA Gold Cost PM of US$ 1,800/ oz. The gold cost closed the year with a minimal gain, regardless of dealing with noteworthy headwinds from the strong U.S. dollar and increasing international rate of interest. Although the Q4 typical cost was somewhat weaker both q-o-q and y-o-y, a sharp November rally was followed by continued healing throughout the closing weeks of the year.

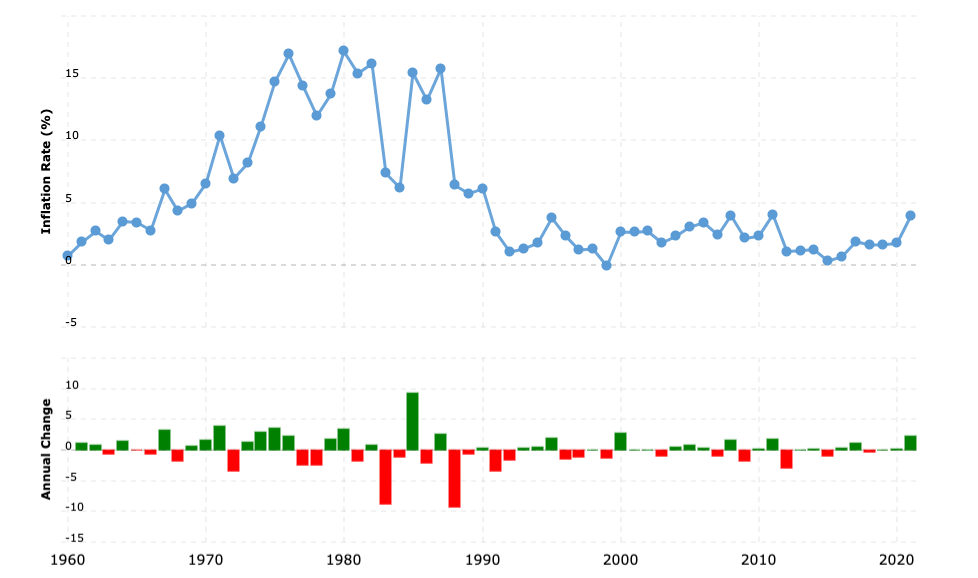

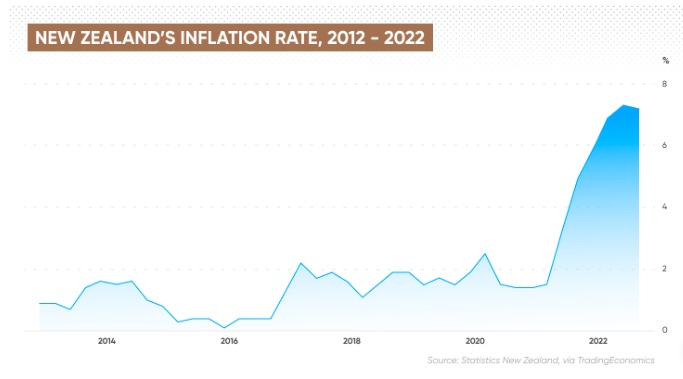

Vigorous retail financial investment raised gold bar and coin need to a nine-year high Strong development in Europe, Turkey and the Middle East balanced out a sharp downturn in China, where need was impacted throughout the year by COVID-related aspects. High and relentless yearly inflation in the Euro location (+8.5 percent in January 2023 and +9.2 percent in December 2022), European Union (+10.4% in December), Turkey (+64.3% in December), UK (+10.5% in December), Canada (+6.3% in December) and the United States (+6.5% in December) has actually sustained the increase in gold costs.

Read likewise: How to buy gold

Indian gold need stayed robust compared to longer-term pre-pandemic levels. In spite of a relatively soft start to the year, Indian customer need recuperated and only simply fell shy of the strong levels of need seen throughout 2021. Continued healing from COVID-19 increased annual contrasts, although the sharp regional cost rally choked off need in the closing weeks of December. India is among the biggest customers of gold on the planet, producing practically no gold itself.

Overall gold supply stopped 2 years of succeeding decreases in 2022, raised by modest gains in all sections. Full-year mine production grew 1% however stopped working to match its 2018 peak. Yearly recycling supply made just limited gains, regardless of strong regional currency cost increases in lots of markets.

Forecasts for 2023

Gold and silver costs are anticipated to increase in 2023 amidst a damaging U.S. dollar and anticipated relieving of the Federal Reserve’s financial policy by the end of 2023, after a project of rate walkings began in March 2022.

The London Bullion Market Association’s (LBMA) yearly study of 30 experts showed careful optimism for these metals. Specialists anticipate gold and silver to typical 3.3% and 8.8% greater by the end of this year compared to 2022.

Amongst the crucial aspects that might set off an increase in costs, 43% of participants called the decrease in the United States dollar and the coming ease of the Fed’s financial policy, while 14%– inflation, and 11%– geopolitical aspects.

Financiers comprehended that the Fed doest not fear to provoke an economic crisis in an effort to reduce a strong inflation it triggered with Quantitative relieving and low rates for more than a years (printing billions of paper currency out of thin air given that 2008).

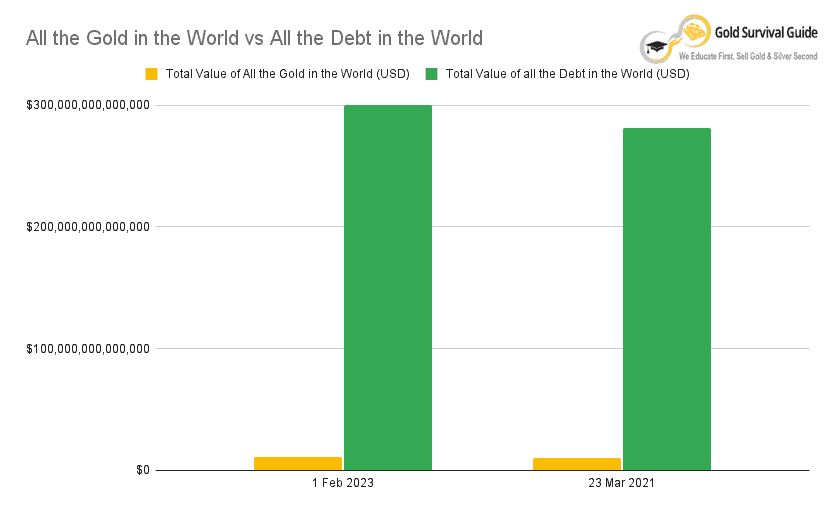

Substantial financial policies trigger inflation and possessions bubbles. Improved by big quantity of credit given by industrial banks, stocks and real estate costs progressively grow in quantitative relieving times. This only includes pressure on the financial resources of middle class homes.

All eyes are now on U.S. customer cost index (CPI) report due on February 14, 08:30 AM. Inflation in the U.S. for December 2022 was formally at +6.5%, after +7.1% in November. Financiers and main lenders hope that CPI report for January 2023 will reveal a even lower inflation.

Other information improve the gold costs development. Undoubtedly, reserve banks worldwide have been accumulating gold reserves since 2020 at a furious pace last seen 55 years ago when the U.S. dollar was still backed by gold. According to the World Gold Council (WGC), central banks bought a record 399 tonnes of gold worth around $20 billion in the third quarter of 2022 and 417 tonnes in Q4 2022. This put the central banks purchases of gold in 2022 at 1,136t, the majority of which was unreported.

In addition, BRICS countries are working on a new reserve currency, which could be based on a currency baskets (ruble, renminbi, ruppee, real and rand) mixed with commodities prices such as oil, gas and precious metals. All the BRICS countries (Brazil, Russia, India, China and South Africa) are large producers of gold and their central banks hold hundreds of tons of the yellow metal.

While inflation in the U.S. has remained high since summer 2021, there are growing signs that high interest rates are beginning to slow the economy, the housing market is slumping, and mortgage rates nearly doubling, after the Fed carried out aggressive hikes.

Gold traders agree that the long-term gold trajectory is up. The price of the yellow metal will continue growing in 2023, because of persistent inflation, war in Ukraine, recession in Europe and the U.S., as the central banks cannot anymore raise interest rates without collapses of heavily indebted states, corporations and real estate markets.

Some traders expect gold price to rise to $1,980 an ounce in early 2023.

The U.S. Federal Reserve will have no choice but to pivot and lower interest rates in 2023 (in Q2 or Q3), in order to reduce the impact of the coming recession.

Thus, we expect gold price to cross $2,000 in Q2 and $2,100 in Q3. Gold prices could hit $1,980 a troy ounce in early February after the U.S. Federal Reserve announced an interest rate hike by 0.25 percentage point. That takes it to a target range of 4.5%-4.75%, the highest since October 2007.

The move marked the eighth increase in a process that began in March 2022.

As expected, gold price jumped to $1,951 per troy ounce on Wednesday February 1st, and gold futures hit $ 1,965

Thank you for being among our readers.

Our community already has nearly 100,000 members.

Sign up to get our exclusive articles.

To receive premium content, subscribe, it’s only €8.99/month. You will see the subscription form on posts with restricted access.

Support us by sharing our publications!

Follow us on Facebook, Twitter and Anchor.

© Copyright 2023 — Swann Collins, financier, author and specialist in worldwide affairs.