Ther e continues to be much conversation about just how much greater rate of interest will go. Such as whether the Reserve bank of New Zealand is close to stopping briefly on its rates of interest boosts? Nevertheless, today you’ll see why it is the genuine rates of interest that we require to keep an eye on …

Approximated reading time: 9 minutes

Rates Of Interest in New Zealand have actually increased dramatically off the historical lows they were at up till September 2021. Although the boosts over the previous year have actually just taken the Authorities Money Rate (OCR) approximately the level it was at in 2015. See chart listed below.

What will the Reserve Bank of New Zealand perform in coming months? Are rates most likely heading even greater? Or will the next relocation by the New Zealand reserve bank be to stop briefly and take a look at the impacts or the rate increases up until now?

Our guess is whatever the reserve bank does will be either prematurely or far too late. As that is what takes place when you have a lot of old males attempting to select the rate of cash rather of the marketplaces.

Nevertheless, certainly the rates of interest has a bearing for those New Zealanders with a home loan and organizations with loans. However instead of concentrating on the reserve bank statement every quarter, we believe there is a a lot more crucial rates of interest to watch on.

That is, what is the present “ Genuine Rate Of Interest” in New Zealand?

How Do Genuine Rates Of Interest Vary From the Overnight Money Rate (OCR) that the Reserve Bank Fiddles With?

What are genuine rate of interest?

The genuine rates of interest is the small rates of interest, less the present rate of inflation.

The small rates of interest just describes the priced quote rates of interest on the similarity a federal government bond or reserve bank set rates of interest. The present rate of inflation is revealed by the federal government customer rate index (CPI).

Why is the “After Inflation” Rate Of Interest So Essential?

Why is this so crucial?

Due to the fact that it reveals you what return you are getting on your cash after inflation When this number gets listed below 2% and in specific listed below no (likewise understood then as an Unfavorable Genuine Rate Of Interest) this is when it is a specifically great time to hold gold.

Why is that?

Due to the fact that when rate of interest are really low, there is then no “chance expense” in holding gold. This just suggests you are not losing out on returns in other places– such as interest in a checking account.

As the gold haters like to advise you, gold pays you no interest. However when the bank pays you no interest (or beside none) it makes good sense to switch your money for gold rather. Due to the fact that in this sort of environment, you stand a far better possibility of keeping your wealth and your buying power with gold.

Also, even when small rate of interest are greater, if inflation rates are greater still, you are likewise getting no return after inflation.

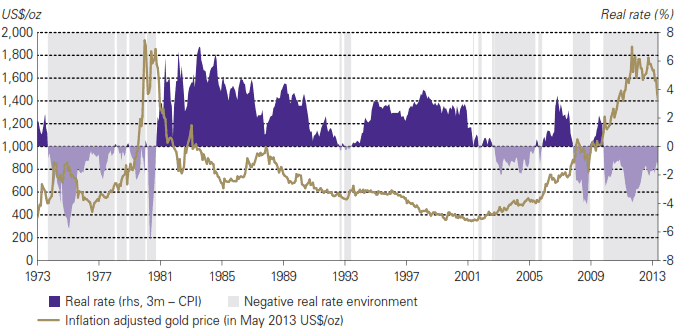

The chart listed below programs this relationship in between United States genuine rate of interest and the gold rate in United States Dollars.

Source: gold.org

So What is the Genuine Rate Of Interest in New Zealand Currently?

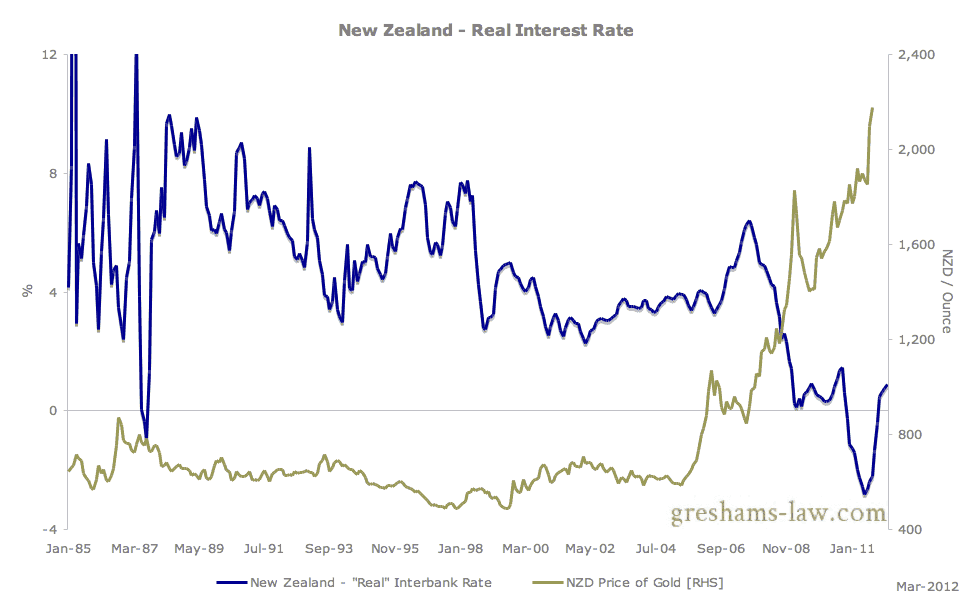

Formerly we had the ability to just describe the outstanding charts readily available on Greshams-law. com. These had the advantage of outlining genuine rate of interest in numerous nations consisting of New Zealand. Sadly that website no longer appears to be running. So the most approximately date chart we have from them just runs till 2012:

Source

How do you Compute the Genuine Rate Of Interest?

The meaning from Greshams-Law. com for ‘genuine’ rate of interest, was the short-term inter-bank rate minus the year-on-year development in the customer rate index. The CPI rate originates from the OECD data. For that reason this information is just as excellent as each federal government CPI procedure, which likely suggests inflation is in fact greater than this!

For more on this see: Comparing NZ Cash Supply, Federal Government Inflation Data, Home Rates, and Gold Rates for the Last 19 Years

In some cases we see other procedures such as a 3 month bond or perhaps a longer outdated bond, such as a year, utilized. These will obviously normally offer a somewhat greater rates of interest than the interbank financing rates which are an over night rate.

Nevertheless the distinction is not too substantial. Today it is just 0.78% in between the interbank lending rate and the 90 day Bank Expense Rate in New Zealand (Source). The crucial thing we are trying to find in evaluating genuine rate of interest is the instructions they are heading– the pattern.

So we’ll stick to the interbank rate. It likewise has the benefit of going a long method back compared to some New Zealand federal government bond information.

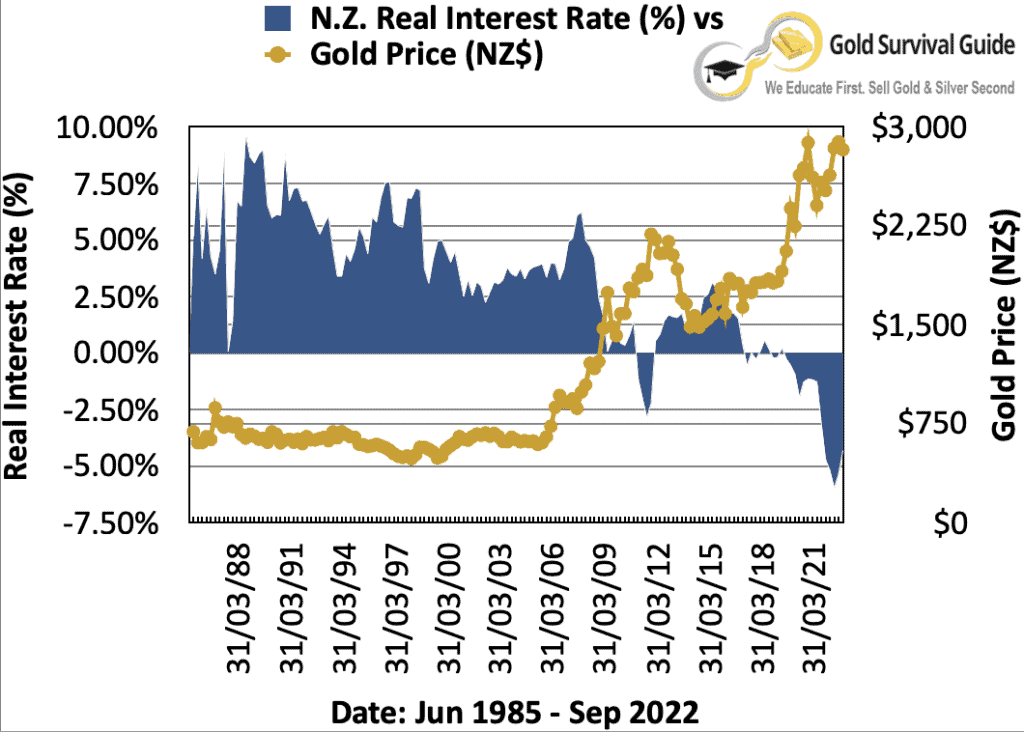

The listed below chart reveals genuine rate of interest in addition to the regional New Zealand Dollar gold rate each quarter. (A suggestion, genuine rate of interest are the interbank lending rate, less the modification in the Customer Rate Index (CPI) from a year prior). Our chart just returns to 1985. As that is as far as the RBNZ month-to-month information on wholesale rate of interest goes. The most recent CPI information readily available is for the September Quarter. So the chart runs till September 2022.

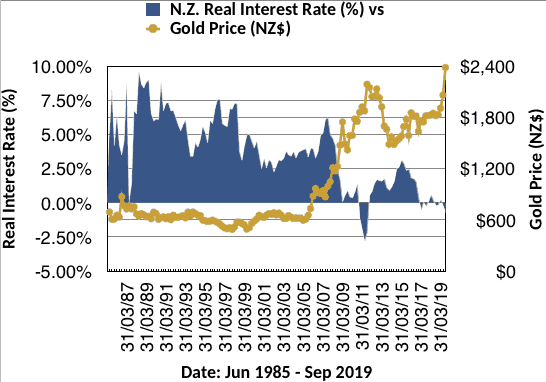

Here is the chart since September 2019 to demonstrate how far more unfavorable rates have actually ended up being in the previous 3 years ever since.

Source: RBNZ, Statistics NZ, World Gold Council

The Relationship In Between Gold and Genuine Rates Of Interest

To our eye there seems a quite strong inverted relationship in between genuine rate of interest and the gold rate in New Zealand dollars.

Throughout the 1980’s and 90’s the gold rate was relatively flat or down, as genuine rate of interest stayed high. Balancing maybe around 5%.

In the early 2000’s gold began to increase as genuine rate of interest moved down towards 2.5%. Then they fell dramatically, initially to no and after that even lower to -2.50%. This was when the NZD gold rate truly moved higher. Going from under $1000 to peak at over $2100 in 2011.

However then the “after inflation rates of interest” began to head greater. Throughout this time gold was fixing lower. In 2015 the genuine interest returned quickly above 3% prior to turning lower. This is likewise about the time when the NZD gold rate likewise began to resumed its upwards pattern.

Ever since the inverted relationship has actually continued.

You can see that over the previous couple of years, the NZ dollar gold rate has actually been trending up, while genuine rate of interest have actually been trending down. This is the really relationship we went over previously. That is, when genuine rate of interest are unfavorable– or near it– gold normally carries out well as there is no chance expense in holding gold.

Genuine rate of interest when again dipped into unfavorable area over the last few years. In 2020 they went much more unfavorable. While gold in NZ Dollars struck a brand-new record high over $3000.

Are you currently stressing over low returns in the bank? These numbers reveal they are currently unfavorable, specifically when keeping tax is considered.

However What if We Get Greater Inflation therefore Rates Of Interest Start to Increase?

The talk from financial experts has more than the previous year unexpectedly changed to just how much greater rate of interest might go. (They keep modifying up their anticipated rates of interest peaks).

This is what took place in the 1970’s– rate of interest were really high, in the teenagers in reality. However inflation was even greater therefore gold was increasing while small rate of interest were increasing. However in reality genuine rate of interest stayed unfavorable.

So disregard any remark about how increasing rate of interest are bad for gold as it is the Genuine Rates of interest that matters.

Where to Next genuine Rates Of Interest in New Zealand?

In current months we have actually seen the gold rate falling or going sideways, in addition to genuine rate of interest getting less unfavorable. They have actually dropped from a high of practically -6% in March 2022 to -4.3% in September. This has actually triggered some to believe the bull run in gold is over.

Nevertheless we ‘d state this a bit early.

Why?

It appears not likely that the OCR will be raised high enough to return inflation to a level less than the level of present rate of interest. At the end of the inflationary 1970’s it took rate of interest being held at 3% greater than inflation to get the inflation genie back in the bottle. And this continued for several years not simply months.

If reserve banks were to try this we ‘d see more than simply an economic downturn or decrease. With present dept levels there ‘d likely be a huge crash in numerous markets: Realty, stock exchange, and bond markets. There are currently cautions in bonds markets. See this outstanding post for why a crash in bond markets might be most likely.

So we ‘d think it’s far more most likely that main lenders will bear with an extended period of high inflation instead of run the risk of a big crash. We ‘d anticipate them to cut rate of interest and even go back to more currency printing. Hence most likely stiring a 2nd wave of inflation.

For that reason this present turn up in genuine rate of interest might simply be momentary prior to we see a “double dip”.

We ‘d state it makes good sense to watch on this chart. In the long run genuine rate of interest might get back at more unfavorable than they have actually been.

So it’s most likely that gold in NZD will stay the location to be while this is going on. While it may not be a straight line greater, we believe there will be much greater gold costs in New Zealand dollars to come yet. Have you purchased gold yet? Inspect the variety of gold and silver to purchase here.

Make sure to register to our weekly short article updates listed below. We’ll keep you notified on subjects like this pertinent to the New Zealand purchaser of gold.

Editors Note: This short article was very first released 8 May 2012. Last upgraded 8 November 2022 to consist of all brand-new charts with newest New Zealand information. Plus brand-new commentary.

Source link

![Real Interest Rates vs Gold Prices - What Can They Tell Us About When to Buy Gold in New Zealand? [2022 Update]](https://expresspage.net/wp-content/uploads/2023/01/Real-Interest-Rates-vs-Gold-Prices-What-Can-They.png)